Monsanto Company (NYSE: MON) generated an outstanding return on equity of 43.5% over the past twelve months, while the Materials sector returned 6.1%. Even though Monsanto's performance is highly impressive relative to its peers, it's useful to understand what's really driving the company's strong ROE and how it's trending. Understanding these components may change your views on Monsanto and its future prospects.

Monsanto's Return On Equity

Return on equity represents the percentage return a company generates on the money shareholders have invested. Return on equity or ROE is defined as follows:

ROE = Net Income To Common / Average Total Common Equity

A higher return on equity suggests management is utilizing the capital invested by shareholders efficiently. However, it is important to note that ROE can be "manufactured" by management with the use of leverage or debt.

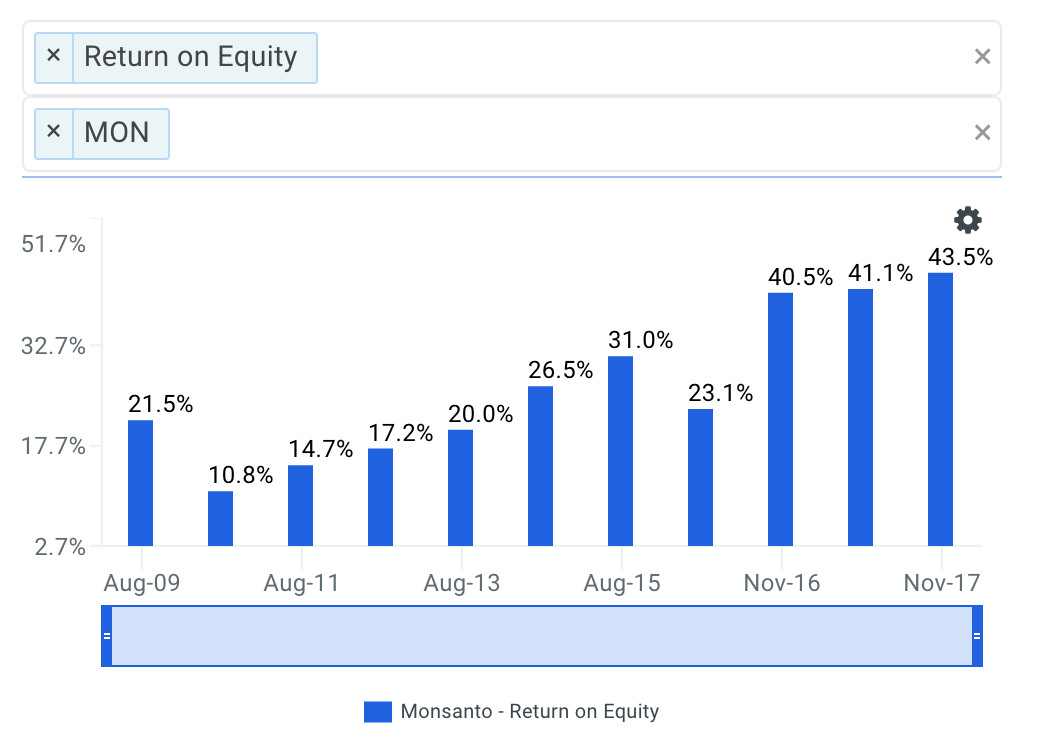

Monsanto's historical ROE trends are highlighted in the chart below.

source: finbox.io data explorer - ROE

It appears that the return on equity of Monsanto has generally been increasing over the last few years. ROE decreased from 31.0% to 23.1% in fiscal year 2016, increased to 41.1% in 2017 and increased again to 43.5% as of LTM Nov'17. So what's causing the general improvement?

What's Driving Monsanto's Improving Return On Equity

The DuPont analysis is simply a separate way to calculate a company's ROE:

ROE = Net Profit Margin * Asset Turnover * Equity Multiplier

Created by the DuPont Corporation in the 1920s, the analysis is a useful tool that helps determine what's responsible for changes in a company's ROE. It highlights that a firm's ROE is affected by three things: profit margin, asset turnover, and its equity multiplier or financial leverage.

Analyzing changes in these three items over time allows investors to figure out if operating efficiency, asset use efficiency or the use of leverage is what's causing changes in ROE. Strong companies should have ROE that is increasing because its net profit margin and/or asset turnover is increasing. On the other hand, a company may not be as strong as investors would otherwise think if ROE is increasing from the use of leverage or debt.

So let's take a closer look at what's driving Monsanto's returns.

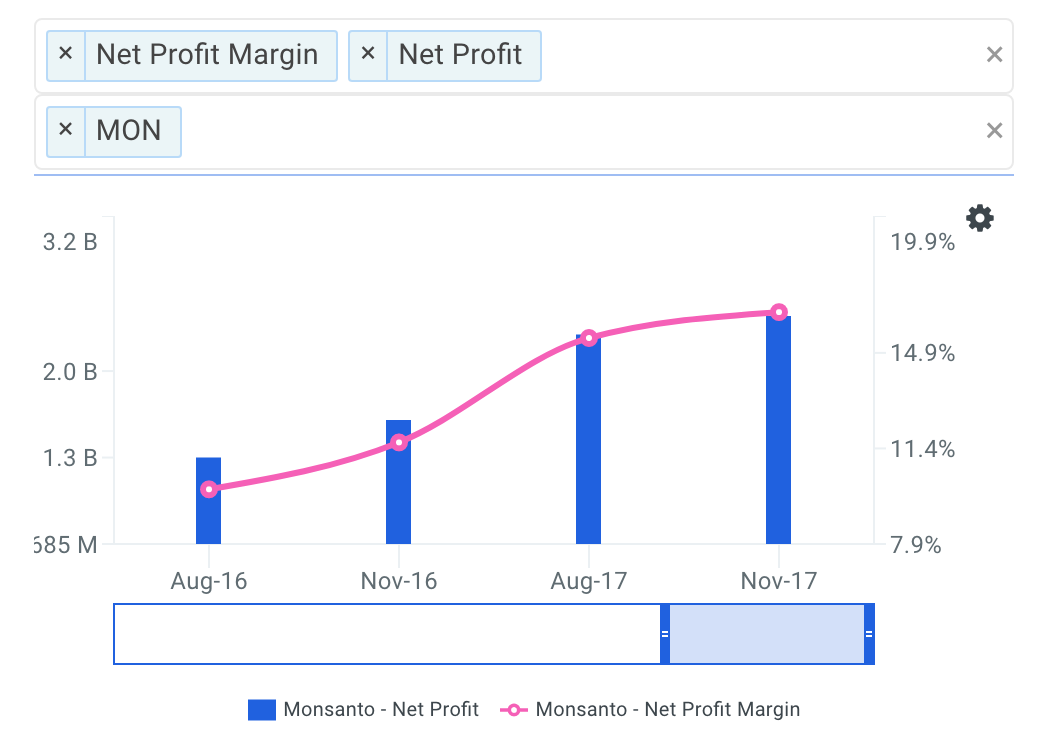

Monsanto's Net Profit Margin

It appears that the net profit margin of Monsanto has generally been increasing over the last few years. Margins decreased from 15.4% to 9.9% in fiscal year 2016, increased to 15.4% in 2017 and increased again to 16.4% as of LTM Nov'17.

source: data explorer - net profit margin

Therefore, the company's increasing margins help explain, at least partially, why ROE is also increasing. Now let's take a look at Monsanto's efficiency performance to see if that is also boosting ROE.

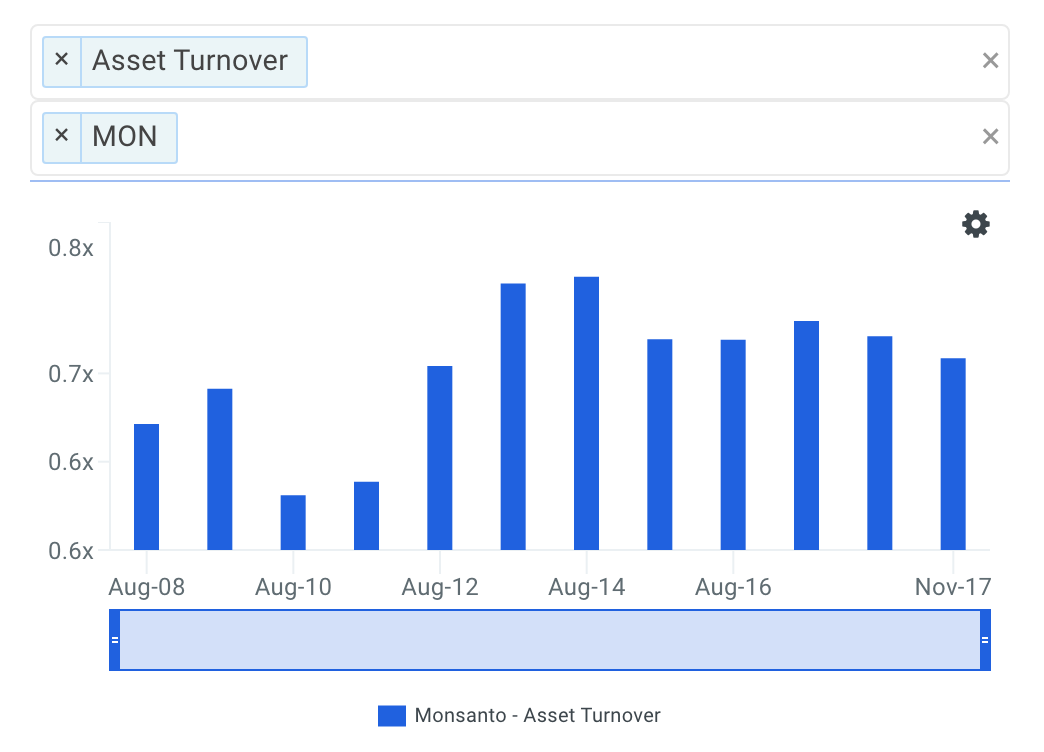

Monsanto's Asset Turnover

It appears that asset turnover of Monsanto has generally been declining over the last few years. Turnover decreased from 0.68x to 0.65x in fiscal year 2016, increased to 0.71x in 2017 and decreased to 0.66x as of LTM Nov'17.

source: data explorer - asset turnover

Therefore, the company's ROE improvement is not as a result of its asset turnover performance which has generally been decreasing.

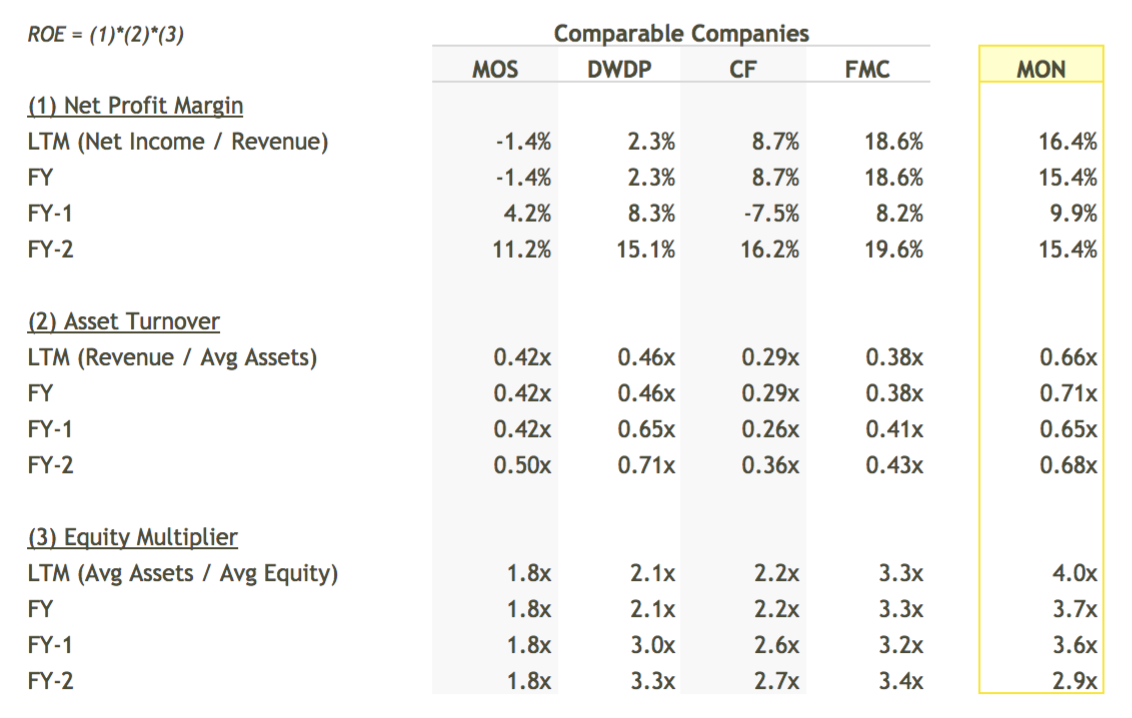

Finally, the DuPont constituents that make up Monsanto's ROE are shown in the table below. Note that the table also compares Monsanto to a peer group that includes Mosaic Company (NYSE: MOS), Dow Chemical Company (NYSE: DWDP), CF Industries Holdings, Inc. (NYSE: CF) and FMC Corporation (NYSE: FMC).

source: finbox.io's DuPont model

In conclusion, the DuPont analysis has helped us better understand that Monsanto's general improvement in return on equity is the result of an improving net profit margin, a declining asset turnover ratio and increasing leverage. Therefore when looking at the core operations of the business, Monsanto shareholders have reason to be excited due to the company's general improvement in profitability along with a slight decline in operational efficiency.

The DuPont approach is a helpful tool when analyzing how well management is utilizing shareholder capital. However, it doesn't necessarily tell the whole story. For example, how do the company's ROE trends compare to its peers or sector? How about in absolute returns? I recommend that investors continue to research Monsanto to gain a better understanding of its fundamentals before making an investment decision.

Author: Matt Hogan

Expertise: Valuation, financial statement analysis

Matt Hogan is also a co-founder of finbox.io. His expertise is in investment decision making. Prior to finbox.io, Matt worked for an investment banking group providing fairness opinions in connection to stock acquisitions. He spent much of his time building valuation models to help clients determine an asset’s fair value. He believes that these same valuation models should be used by all investors before buying or selling a stock.

His work is frequently published at InvestorPlace, Benzinga, ValueWalk, AAII, Barron's, Seeking Alpha and investing.com.

Matt can be reached at [email protected].

As of this writing, I did not hold a position in any of the aforementioned securities and this is not a buy or sell recommendation on any security mentioned.