ON Semiconductor Corp (NASDAQ: ON), an information technology firm with a market capitalization of $11.3 billion, saw its share price increase by 26.8% over the prior three months. As a large-cap stock with high coverage by analysts, you could assume any recent changes in the company’s outlook is already priced into the stock. But is there still an opportunity here to buy? Let’s examine ON Semiconductor's valuation and outlook in more detail to determine if there’s still a bargain opportunity.

What Is ON Semiconductor Worth?

Welcoming news for investors, ON Semiconductor is still trading at a fairly cheap price. According to our 7 valuation analyses, the intrinsic value for the stock is $32.58 per share and is currently trading at $25.81 in the market. This means that there is still an opportunity to buy now.

| Analysis | Model Fair Value | Upside (Downside) |

|---|---|---|

| 10-yr DCF Revenue Exit | $31.54 | 22.2% |

| 5-yr DCF Revenue Exit | $31.66 | 22.7% |

| Peer Revenue Multiples | $32.83 | 27.2% |

| 10-yr DCF EBITDA Exit | $38.86 | 50.6% |

| Peer EBITDA Multiples | $33.06 | 28.1% |

| 10-yr DCF Growth Exit | $30.25 | 17.2% |

| 5-yr DCF Growth Exit | $29.83 | 15.6% |

| Average | $32.58 | 26.2% |

Click on any of the analyses above to view the latest model with real-time data.

What’s more interesting is that ON Semiconductor’s share price is quite volatile, which gives us more chances to buy since the share price could sink lower (or rise higher) in the future. This is based on its high beta, which is a good indicator for how much the stock moves relative to the rest of the market.

How Much Growth Will ON Semiconductor Generate?

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company’s future expectations.

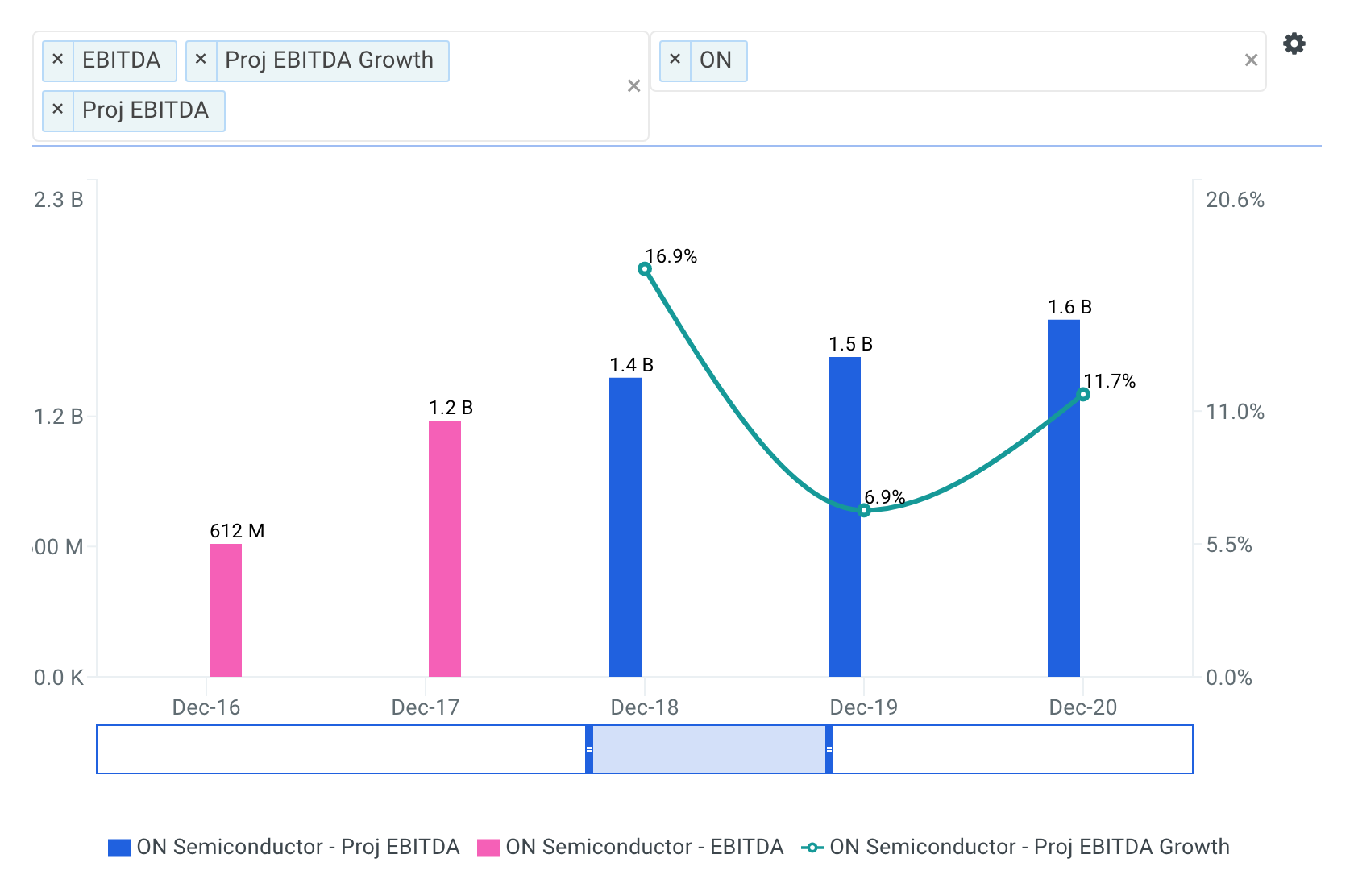

source: finbox.io data explorer

With EBITDA expected to grow 16.9% in fiscal year 2018, the future certainly appears bright for ON Semiconductor. In addition, Wall Street analysts are forecasting that ON Semiconductor's EBITDA margin will reach 27.6% by fiscal year 2020, representing an increase of 6.3% from its LTM EBITDA margin of 21.3%.

It looks like higher cash flows are in the cards for shareholders, which should feed into a higher share valuation.

Next Steps

ON Semiconductor's optimistic future growth does not appear to have been fully factored into the current share price just yet. The stock still looks to be trading below its fair value. At the current price, investors may be asking if they should buy or add more to their position? If you believe ON Semiconductor is currently trading below its intrinsic value, buying low and selling when its price reaches its true value can be profitable.

I recommend you continue to research ON Semiconductor to get a more comprehensive view of the company by looking at:

Risk Metrics: what is ON Semiconductor's cash ratio which is used to assess a company's short-term liquidity. View the company's cash ratio here.

Risk Metrics: how much interest coverage does ON Semiconductor have? This is a ratio used to assess a firm's ability to pay interest expenses based on operating profits (EBIT). View the company's interest coverage here.

Efficiency Metrics: how much free cash flow does ON Semiconductor generate as a percentage of total sales? Has it been increasing or decreasing over time? Review the firm's free cash flow margin here.

Author: Matt Hogan

Expertise: Valuation, financial statement analysis

Matt Hogan is also a co-founder of finbox.io. His expertise is in investment decision making. Prior to finbox.io, Matt worked for an investment banking group providing fairness opinions in connection to stock acquisitions. He spent much of his time building valuation models to help clients determine an asset’s fair value. He believes that these same valuation models should be used by all investors before buying or selling a stock.

His work is frequently published at InvestorPlace, Benzinga, ValueWalk, AAII, Barron's, Seeking Alpha and investing.com.

Matt can be reached at [email protected].

As of this writing, I did not hold a position in any of the aforementioned securities and this is not a buy or sell recommendation on any security mentioned.