- With competition in the payment processing space intensifying, companies looking to differentiate would do well to implement Amazon’s “Day 1” philosophy.

- Verifone Systems appears to have done as much, as management has adapted to today’s point-of-sale merchants requiring more than just payment processing services.

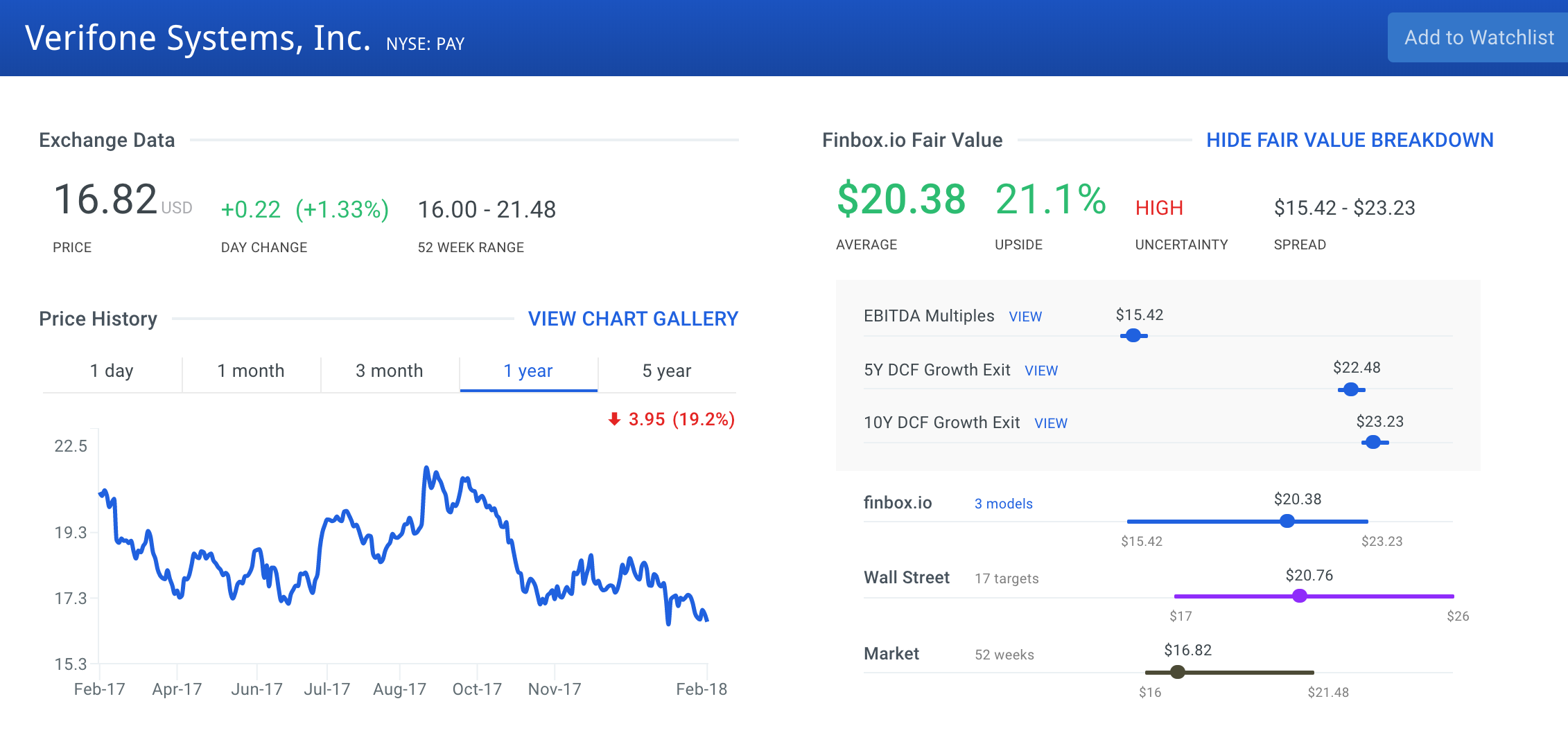

- Next generation products and services and divesting unprofitable business lines has Verifone well-positioned just as its stock shows 25% upside.

Back to “Day 1”

Since 1997, founder and CEO of Amazon (Nasdaq: AMZN) Jeff Bezos has attached his inaugural shareholder letter to the end of each year's current letter. More than just a token gesture, Bezos credits the business principles in his original letter for Amazon’s supernormal growth.

Together, the underlying principles are described by Bezos as maintaining a "Day 1" mentality. Day 1 companies typically embrace industry trends and maintain a consumer-focused (versus product or competitor) strategy.

Established companies often get paralyzed by consumer or technological trend changes, opting for the more comfortable strategy of forging ahead with what they have always done. However, that's typically a recipe for a downfall that Bezos describes as Day 2:

“Day 2 is stasis. Followed by irrelevance. Followed by excruciating, painful decline. Followed by death. And that is why it is always Day 1.”

A bleak picture for companies that hesitate to adapt. Those companies would do well to derive a strategy from the old saying "If you can't beat them, join them." One way to “join them” is to adopt proven business principles.

That seems to be what electronic device payment manufacturer Verifone Systems Inc (NYSE: PAY) has effectively done. With processing services becoming commoditized and nimbler startups competing on hardware, Verifone has slimmed its offering and is allocating resources and solutions to better serve its customers.

With a focused new strategy and finbox.io's valuation models showing nearly 25% upside, let's take a closer look at Verifone before it reports earnings next Thursday.

The Verifone Business Model

Verifone is a global leader in designing, manufacturing, and marketing payment and commerce solutions at the point of sale (POS). The company’s products and services ensure secure payments that meet regulatory and industry compliance standards and enhance merchants’ relationships with consumers.

Operating in over 150 countries, Verifone’s customers are from a variety of industries including financial services, retail, petroleum, restaurants, transportation, hospitality, and healthcare. The company derived 34% of its $1.9 billion total fiscal 2017 revenues from the United States with the remainder internationally (39.3% EMEA, 15% Latin America, and 13% Asia-Pacific).

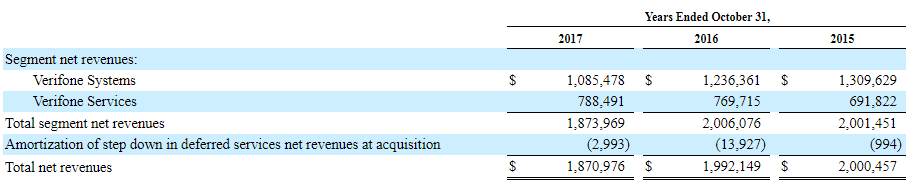

Verifone separates its business into two global product lines: Verifone systems and Verifone services. The systems segment includes its POS devices, security and encryption software, and certified payment software. The service segment includes delivering device-related leasing and maintenance, payment transaction routing and reporting, and other commerce-based services.

Source: Verifone's 2017 10K

Some of Verifone’s main competitors include Ingenico, PAX Technology, Equinox Payments and CyberNet. In the United States, Verifone holds over a 50% share of the terminal market. Verifone also competes with newer companies including Square Inc (NYSE: SQ) and Clover.

Recent Results and Implementing “Day 1” Principles:

Recent Results

For Verifone’s fourth quarter (ending October 2017), the company earned record service revenues of $208 million and net revenues of $477 million with non-GAAP net income per diluted share of $0.44. For the full year, Verifone earned $1.871 billion in net revenue and a GAAP net loss per diluted share of $1.55 ($1.31 net gain non-GAAP). While 2017 was a year of launching Verifone’s next-generation products, the theme for 2018 will be scaling them internationally.

Catering to the Consumer

Verifone operates in a dynamic and very competitive market with customers demanding more and more services on top of its traditional offerings. These additional offerings include advanced integration with enterprise software applications and business management systems. As such, Verifone used 2017 to better serve its customer and transformed itself from a terminal sales company to a platform services company. Its newest technologies allow merchants to utilize additional features including monitoring performance and data analysis.

Simplifying its Focus

In order to maximize its transformation, management simplified its business lines with a number of divestitures. Verifone divested its controlling stake in its China business ($11.2M revenue) and sold its Taxi solutions business in December ($106.5M of fiscal 2017 revenue and a $4.5M operating loss).

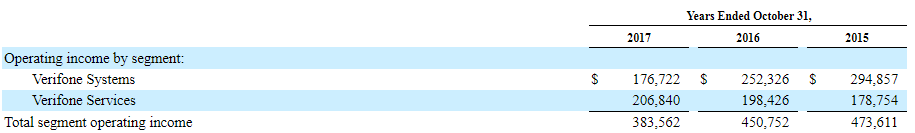

Divestitures have helped to bring down Verifone’s total debt over the last few years. From $1.3B in 2012, Verifone’s long-term debt now stands at $762M:

Source: finbox.io

Price Check: Valuing Verifone’s Shares

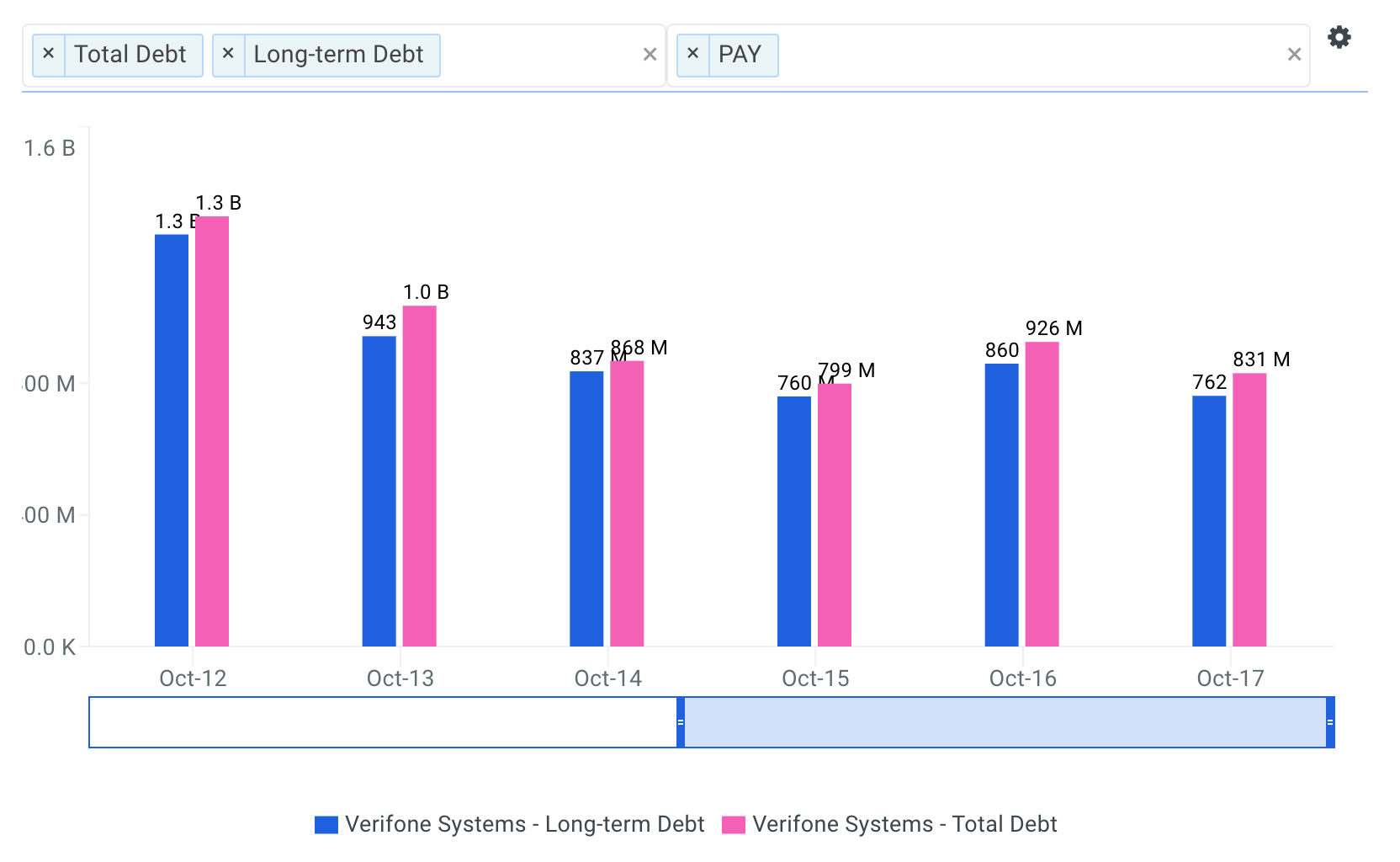

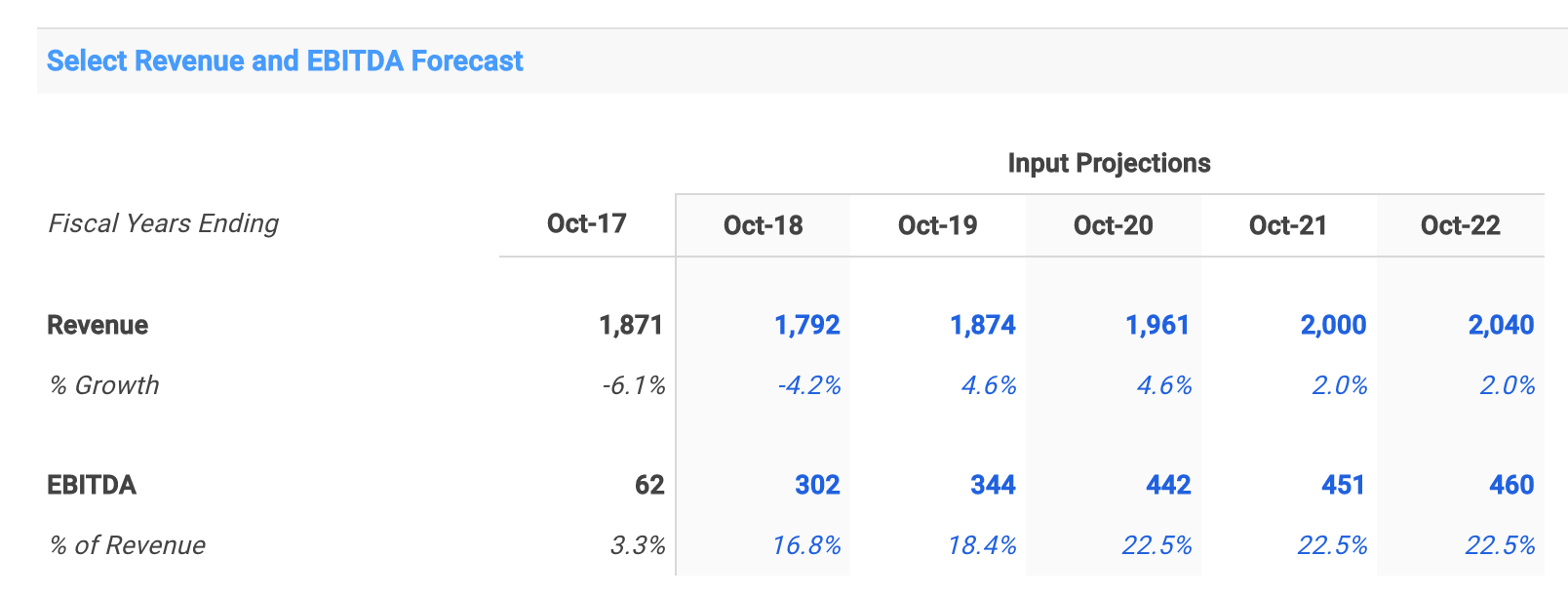

For 2018, the consensus among Wall Street analysts is a slight improvement in revenue performance, from -6.1% in 2017 to -4.2%. EBITDA margin is expected to come in at 16.8%:

Source: finbox.io

Looking ahead through 2022, analysts expect low-single-digit revenue growth and cost-cutting efforts to help expand EBITDA to 22.5%.

If we assume these forecasts across three of finbox.io’s valuation models, we get a $20.37 average estimate of fair value per share. Analysts come in a little bit higher with a $20.76 consensus estimate or nearly 25% of upside to recent trading levels. Management also announced a $100 million stock repurchase program in December:

Risks:

Competition in the payment processing space is high, with hardware becoming increasingly commoditized. Verifone must deliver incremental value on its traditional product offering with its next-generation devices and services. Foreign-currency translations continue to pose a risk as does any slowdown in the global economy.

Checkout: Verifone Conclusion

Companies must continually adapt to industry trends and cater to their customers’ evolving needs. Verifone management’s recent strategic decisions appear to be a move in that direction. A slimmed down product offering, next-generation product launches, and a transformation to a payment-as-a-service company all look to position the company well going forward.

With even just moderate revenue growth assumptions, Verifone’s stock looks to offer almost 25% upside according to a number of valuation models. Value investors may want to take a closer at this leading payment solutions provider ahead of earnings next week.

Author: Matt Hogan

Expertise: Valuation, financial statement analysis

Matt Hogan is a co-founder of finbox.io. His expertise is in investment decision making. Prior to finbox.io, Matt worked for an investment banking group providing fairness opinions in connection to stock acquisitions. He spent much of his time building valuation models to help clients determine an asset’s fair value. He believes that these same valuation models should be used by all investors before buying or selling a stock.

His work is frequently published at InvestorPlace, Benzinga, ValueWalk, AAII, Barron's, Seeking Alpha and investing.com.

Matt can be reached at [email protected].

As of this writing, I did not hold a position in any of the aforementioned securities and this is not a buy or sell recommendation on any security mentioned.