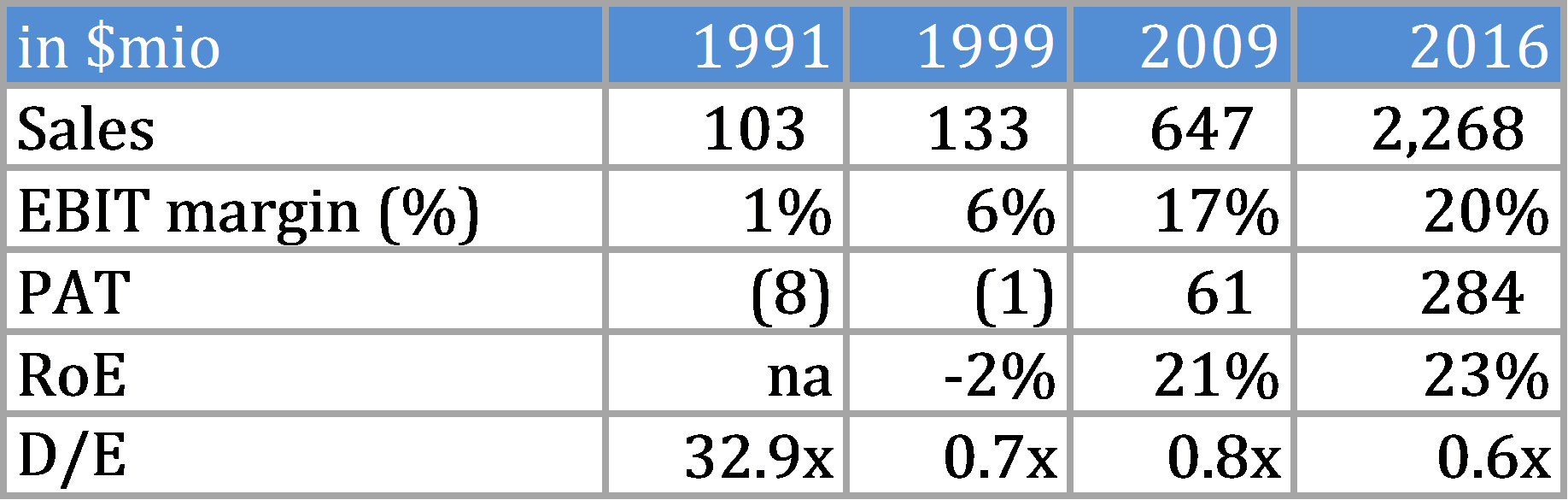

One way to look for investments is to look for something that astonishes you. Middleby Corporation's (NasdaqGS:MIDD) evolution over the last 25 years astonished us. Over the period, the sales grew by 22x, profits rose at a much higher rate, balance sheet strengthened considerably, while the returns on equity increased to a stunning 23%.

Then comes curiosity. What changed in this business after 1999?

Context: Middleby's History

Middleby was founded in 1888 by Joseph Middleby and John Marshall to produce custom portable ovens for the baking industry. Till it was acquired by TMC Industries in 1983 in a leveraged deal, it produced baking ovens and had a strong brand backed by patents. After the acquisition, it entered into the conveyor oven business for the pizza industry which became quite popular among the fast food pizza chains. And then, in 1989, it again took significant debt to acquire the Foodservice Equipment Group of Hussmann Corp for $63 million, with a strategy of becoming a diversified kitchen equipment manufacturer. The acquisition gave it strong brands (Southbend, Toastmaster, etc) and gave it entry to multiple industry lines like refrigeration, core cooking, holding and serving systems, etc. This was followed by another acquisition in the Philippines in 1990 to enter the international market. Middleby also had a manufacturing division in the Philippines, and a distribution arm which catered to global clients by offering sourcing/set-up of kitchen equipment. The acquisitions stretched the balance sheet again and the company spent the next few years trying to repair itself.

A company can either grow strong or grow fat, and Middleby grew fat. In the late 1990s, Middleby had five separate divisions within the company and 10,000 product lines, with the strategy of becoming a one-stop shop for commercial kitchen equipment: mixers, ovens, toasters, refrigeration, serving stations, etc.

Then Selim Bassoul joined the business.

Shedding The Fat And Growing Strong

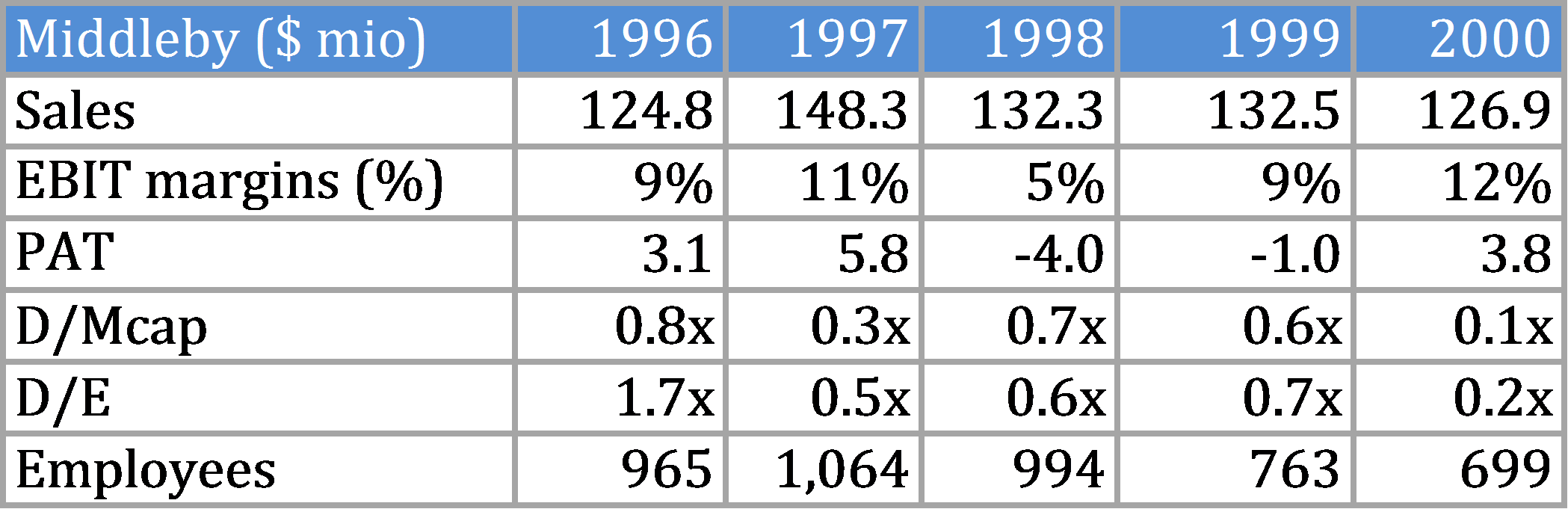

Selim, who worked for 8 years in the commercial food equipment for Premark Inc, joined Middleby in 1996. Subsequent to his joining the firm, the focus shifted to becoming lean. The company made a strategic decision of focusing on only the profitable lines in the cooking and warming segment and decided to exit all other segments.

From 1996 to 2000, the business was rationalized aggressively by the exit from non-core segments like mixers, refrigeration, etc, and consolidating the organizational structure into two divisions (and a reduction in employee count). Middleby exited its low margin / unprofitable businesses and decided to refocus on profitable segments only, where they had and could build on their competitive advantage. The result was that by 2000, while sales remained stagnant, market share in the core segments rose, margins improved, debt was reduced and the company was considerably more efficient. It created a new, simple bonus structure which reduced employee turnover from as high as 40% to less than 10%, and employee to supervisor ratio rose from 25:1 to 90:1.

Middleby shed most of the fat it had accumulated from 1989 to 1996 and decided to focus initially on the cooking or warming segment. So in 2000, Middleby was only in a single segment focusing primarily on commercial food equipment: conveyor oven, convection oven, fryer, steam cooking, toaster, counterline cooking and warming equipment. It had a few brands like Middleby, CTX, Southbend and Toastmaster.

And now in 2016, it is in three synergistic and growing segments:

-

Commercial food service equipment (55% of revenues): Ovens, toasters, fryers, etc. More than 30 leading brands include Middleby Marshall, Turbochef, Blodgett, etc.

-

Food processing equipment (15%): batch ovens, breading machines, food packaging machines, etc. 13 brands including Alkar, Rapipak, MP, etc.

-

Premium residential equipment (30%): kitchen equipment for the residential market. Brands include Viking, AGA, etc.

Middleby's evolution from a single segment focused company, with less than 5 brands to a multi-segment entity with more than 50 brands was driven primarily by acquisitions. Given acquisition led growth, it is important to understand the acquisition strategy.

Acquisition Strategy

The best business is that which generates high returns on invested capital and has avenues to deploy the incremental capital at similar higher rates. The avenues for capital deployment for growth can either be capital expenditures (CapEx) in existing business or acquisition. But statistics say that the base rates for acquisition led growth is quite average. However, since 2001, the Company has made over 40 acquisitions under Bessoul's leadership. Let's see what Bessoul himself has to say on the Company's acquisition strategy:

"Well, I can tell you the reasons that we don’t make an acquisition - growth, or size, or buying a market. So all those three reasons, we will not go after an acquisition to buy a market. It's easy to get growth - I can discount my product and go after a market. I can go steal my competitor’s engineers and get some type of a product emulation. We buy a company because we believe that they have two things that are important to us. One, they have the ability to be already a brand and a patented technology, that is already disruptive. That will take us many, many years to get to.

Number two, the ability to buy it and retain the management so that management allows us to basically, with some capital infused by us and some DNA from Middleby, whether it’s taking them internationally is that in five years or less, would like to have the multiples of that acquisition translate into a price of five times multiple or less after the acquisition integration. We would like also to be accretive in no more than 18 months.

So let’s repeat the three things. One, it has to have a brand with a disruptive technology or patent. Number two, we need to be able to get within five years or less to a five times multiple or less after we realize the synergies and the integration benefits. Number three, it has to be accretive in 18 months or less."

Most acquisitions that happen are done for growth, size or buying a market. While Bessoul's strategy for acquisitions makes sense, it is important to see how the numbers stack up against this stated strategy. The Company acquired only 2 companies until 2004 and began its acquisition spree from 2005 onwards.

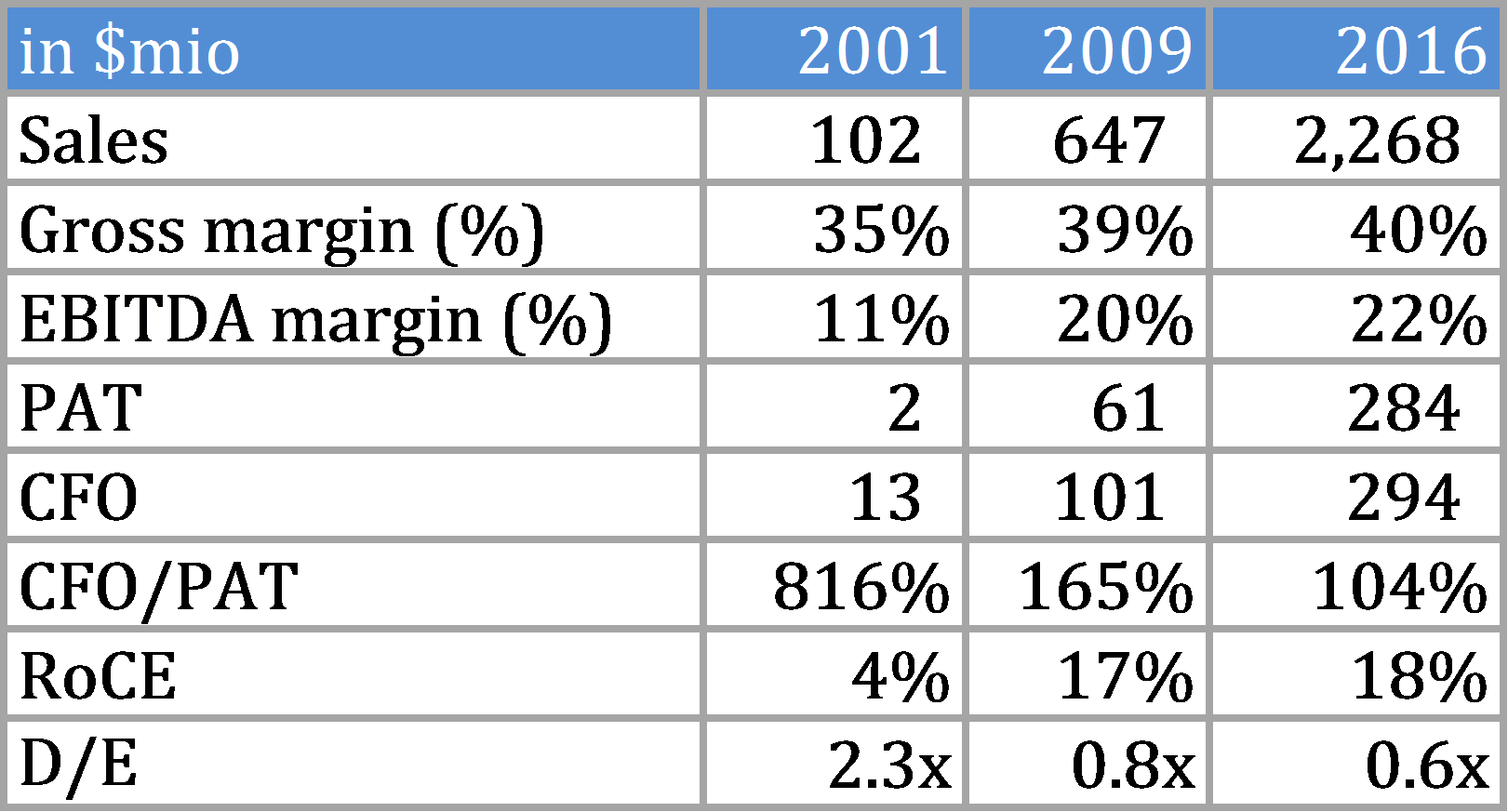

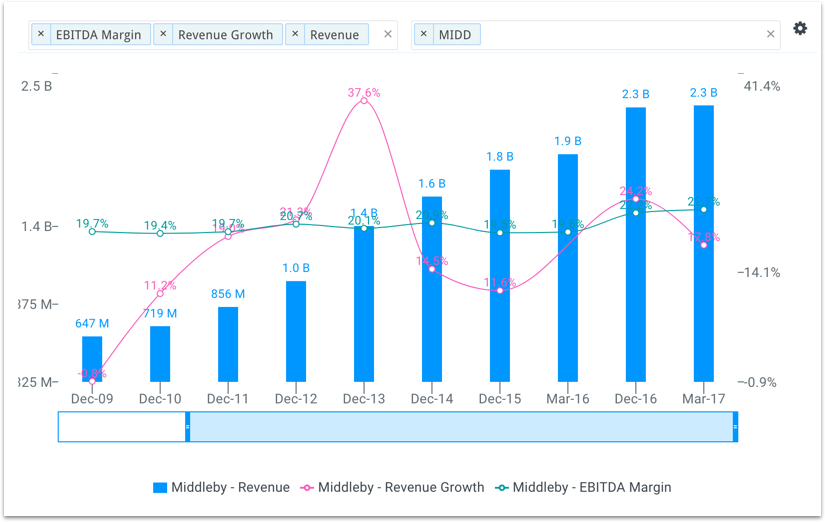

It is no surprise that sales increased since 2001, as that is what acquisitions tend to do. What is interesting to observe is that the gross margins improved to 40% over this period, in fact, the gross margins have never gone below 38% since 2003. Even more impressive is the EBITDA margin improvement which has not gone below 18% since 2004. Also, the cash flows from operations (CFO) has increased considerably at a CAGR of 23% since 2001 and 19% since 2007. In fact, CFO increased every year since 2004 except for two minor dips (<3% yoy).

The financial strength is evident in the D/E ratio which is at a very manageable 0.6x. In fact, the Debt / Market cap is less than 0.2x which coupled with the interest coverage of 19x indicates the robustness of its financial position.

The return on capital employed (RoCE), which includes fixed assets, working capital and the entire goodwill on the books (a conservative approach as it does not include growth component of goodwill) has dipped below 16% only once since 2002 (in 2015 when an acquisition was made that increased the asset base by 33%). It quickly bounced back in 2016.

While the performance has been tremendously successful so far, an important question is whether this is sustainable. Does it have characteristics that would ensure that this will continue into the future? That is, does it have a moat?

Why Would A Competitor Find It Difficult To Compete?

Buffett talks about competitive advantage in terms of moats: those qualitative characteristics which help businesses defy the laws of capitalism. Moats come in many forms but the businesses we like best are those protected by multiple lines of defense, which are strong on their own and also reinforce each other, resulting in a truly strong model.

"Just as animals flourish in niches, similarly, people who specialize in the business world – and get very good because they specialize – frequently find good economics that they wouldn’t get any other way."

-- Charlie Munger

By deciding to focus on dominating a specific niche (cooking and warming) in the food service equipment industry, Middleby was able to generate considerable value for all stakeholders. In 1990s and early 2000s, the market served by Middleby was just around $2 billion, which meant that it was not so big that it attracted the attention of large companies. However, it was large enough for Middleby to grow. And then, slowly through acquisitions, it expanded the niche and its addressable market currently is now ~$13 billion (across 3 industries). It is currently the largest player in the industry by far and the only one which focuses on just this industry, while the competitors are part of conglomerates. How did it dominate the niche?

Branding: Brands matter as they inspire in the customers, the perception of quality, service levels, and other intangibles. For a brand owner, they have value only if they create pricing power or/and if they result in repeat sales. In the case of Middleby, it has a whole host of brands in its stable, which have been in existence for decades, and in some cases for more than a century. The strength of the brands owned by Middleby is evident in the gross margins increasing from 30% in 1994 to 34% in 2001 to 40% currently. It has also resulted in repeat orders in Middleby's major segments: #1 in pizza chains, #1 in convenience stores, #1 in fast casual, #1 in Pan-Asian cuisine, #1 in casual dining, #2 in QSR. Middleby's products are priced at a premium to its competitors, and not without reason.

Patents, technology, innovation: The company's acquisition strategy has brought a number of patents in addition to various industry leading brands. It has a strong set of patents (rather than one single patent which opens it to patent risk) across different product segments which allow it to offer features loved by its customers. In certain instances, it has used the technology available with itself coupled with that obtained through acquisitions to come out with newer features, which have then been patented. Additionally, it has spent >1% of revenues every year for more than 20 years on R&D that helps it to continue to innovate and bring to the market, technologies that are in many cases beyond what the customer is looking for. For example, it came to the market with a touch technology equipment in 2006, way before a touch phone was introduced.

Scale: The brand power backed by the patent and technology capabilities result in a considerable scale of operations. This is further supported by the international business strategy, which was a focus right from the early 1990s. The distribution and the manufacturing scale implies significant advantages for the company. The advertising and research costs on an absolute basis might be high, but the scale results in a competitive fixed cost per unit.

Switching Costs: The fanatic focus on delighting the customer coupled with a strong service focus, brands and an innovation-led culture have led to considerable switching costs for the customer. From a customer's point of view, the major factors in food service equipment are standardized products (can be used across regions), ease of use, quick cooking, energy & labor efficiency, low space usage, and service availability. Many of its products are developed after close discussions with the customer and include considerable customization. For chains which are fast expanding in the international markets, Middleby offers customized products and offers international servicing as well.

It is quite difficult for a competitor to match Middleby's value proposition, and the compelling offering ensures that it almost never loses a customer. One benefit to Middleby investors is its stability in revenues. With most of its chains focusing on aggressive global expansion, Middleby's capabilities imply it is an automatic choice for customers (driven by product quality, service availability and customization for international food preparation). This has been evident with the international revenues contribution to total revenues increasing from 28% in 2011 to 35% in 2016.

The Man Behind The Wheel:

Selim Bessoul is the intelligent fanatic credited with turning Middleby's fortunes around. He joined Middleby in 1996 as the president of the Southbend division, became the COO in 1999 and was made CEO in 2000.

Incentive alignment: The management and shareholder alignment of incentives is extremely important. To indicate his faith in the business, when he became the CEO, he mortgaged his home to purchase the Company stock. Also, he took a major part of his bonus pay in shares. He still holds a significant portion of his wealth in company shares, and his bonus is still linked to company performance and in stock options.

Unconventional approach: The atypical approach to solving issues were a major factor which drove the improvement in Middleby. Mentored and encouraged by Jim Sinegal of Costco, he introduced the first 'no-quibble policy' in the food service equipment industry in the late 1990s, where any customer could return a product with a 100% refund in 90 days, no questions asked. The “no quibble” guarantee was very powerful, as the market share rose and pricing became a smaller factor in the buying decision. It also encouraged customers to tell the company how exactly they felt about the product. Another example of the unconventional approach is the one he took to resolve the employee attrition levels which was 40% when he joined the company. The bonus structure was made simpler and more observable, which was supported by workplace performance awards where any idea that led to productivity was given a $75 award. Here are his thoughts on organizational building:

"I promote the idea of having families working for me. It was the first unconventional thing I did when I joined. It’s been such a success because those people are preachers for other people to join the organization and they now have the leverage to say, ‘we have to succeed together’. People like to work for me because I give them full empowerment.

Everybody in your organization matters. And that’s why I only allow three degrees of separation between me and the lowest ranked person in our organization."

Thoughts on cash: Salim Bessoul is from Lebanon and grew up in the period of civil war. His parents were asset rich but cash poor. Bassoul’s parents had to sell a piece of land they were keeping for their retirement to fund him through college. The experience shaped much of his beliefs in life and the way he would run his business. Below are some of his thoughts on cash: "It doesn’t matter how rich you are, how financially solid you are, cash is king. You have to manage cash. We don’t run our company through net income, we run it through cash. Coming from a culture in the Middle East where cash is everything, it meant something to me. There was no borrowing to be had during a civil war. It was all about cash."

Conservative aggressive approach: We love managements who follow a conservative aggressive approach to managing a business. The conservative philosophy is evident in the thoughts on cash, the strong balance sheet and the willingness to shrink business (as was seen in the beginning of his tenure). The aggression and focus on growth are evident from the strong growth in sales, profits and cash flows through its acquisition strategy.

Giving back: Selim's personality and what he accomplished with Middleby came together in an instructive way recently when he inspired the company's engineers to develop a patented, highly affordable, multi-functional oven in response to the needs of the 50 million refugees in the world. It has a magnifying glass that acts as a solar panel, so beyond cooking the appliance can purify water and charge a cell phone through heat transfer, not using electricity.

Cash Flow Analysis Implies Upside

Using multiple approaches for valuation is important. If all approaches point to undervaluation, then investors should be quite excited about the prospect of a stock. Using finbox.io's 5 and 10 year DCF EBITDA exit models as well as the 5 and 10 year DCF growth exit models to arrive at a fair value indicate nice upside potential for Middleby. For the 5 year projections, we have used a 6.3% CAGR growth in revenues for the next five years and EBITDA margins are projected to reach 26% by the fifth year. For the 10 year projections, we have taken revenue CAGR of 6.3% for the first five years and 4.2% for the next five years, while the EBITDA margins are projected to remain flat at 26% by year 5 and thereafter. Overall, this forecast is conservative based on the company's recent performance.

The list below indicates the fair value based on each approach and the upside/downside from the current price ($120.55). Overall, the company appears to be nearly 15% undervalued when weighting each approach equally.

- 10-Year DCF Model: Gordon Growth Exit = $123.38 (2.3%)

- 5-Year DCF Model: Gordon Growth Exit = $129.85 (7.7%)

- 10-Year DCF Model: EBITDA Exit = $145.36 (20.6%)

- 5-Year DCF Model: EBITDA Exit = $149.24 (23.8%)

Risks To The Thesis:

Keyman risk: Selim Bessoul, the talismanic CEO has been a major influence on the company reaching its strong position that it enjoys currently. This seeming reliance is a risk for the Company.

Economic cycle: The company’s business and financial performance, may be adversely affected by the current and future economic conditions. A decline in business and consumer spending, a reduction in the availability of credit by its existing customers could result in customers electing to delay the replacement of aging equipment.

Currency risk: While the increasing international exposure reduces geographic concentration risk and increases growth avenues, it does expose the company to currency related risks as the forex exposures are not fully hedged.

Conclusion: Buy & Hold

Middleby is a well-run business enjoying strong competitive advantages. The company is run by an exceptional manager whose incentives are aligned with that of the minority shareholders. In addition, the valuation is attractive on a future cash flow basis calculating nearly 15% margin of safety. Value investors should consider this a good business to hold for the foreseeable future or at least until its economics change.

Note this is not a buy or sell recommendation on any company mentioned.

Photo Credit: Thurne