Did you know that close to 90% of spreadsheet documents contain errors?

This was the conclusion found in a recent study by Ray Panko, a professor of IT management at the University of Hawaii. It's unnerving to think of all the potential repercussions when combining this stat with a reported 1.2 billion worldwide Microsoft Office users. Panko, an authority on bad spreadsheet practices, has even called this issue a pandemic.

Checkout these examples of spreadsheet blunders which had significant consequences:

-

The London Whale scandal cost JPMorgan $6.2 billion due to an error that occurred from manually editing Excel spreadsheets.

-

Barclays used an Excel spreadsheet in its purchase of Lehman Brothers in 2008. A mistake in the spreadsheet forced Barclays to purchase 179 toxic contracts it never intended to buy in the $1.35 billion purchase.

-

Fannie Mae’s spreadsheet blunder made the company appear $1.3 billion more profitable in 2003. We should have seen the Great Recession coming!

These spreadsheet errors are just a few notable examples that have been publicized. There has certainly been thousands more we haven’t heard about. While saying that a lack of spreadsheet oversight is a pandemic may be hyperbole, it is a subject finbox.io takes very seriously!

Finbox Reliability Tests

Thousands of investors use our financial models on a daily basis. This means that calculations are continuously tested for accuracy and if any member believes they have uncovered an error - they are encouraged to notify us at hi-at-finbox.io.

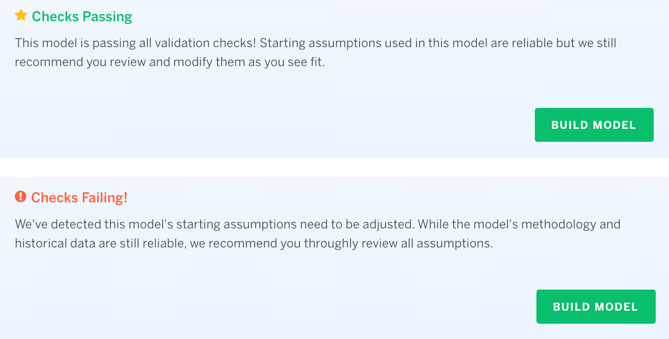

Finbox.io has also implemented a system that automatically tests every financial model to make sure it is reliable. Our servers build and vet 100,000+ models every 12 hours! The vetting process is done by running each model through a series of checks. Members are then notified before opening a model on whether it has passed or failed.

In addition, when a valuation model doesn’t pass all of its required checks, that specific model is excluded from the stock’s finbox fair value estimate.

Introducing Fair Value Uncertainty

Being able to rely on finbox fair value estimates is crucial which is why we’ve recently added Uncertainty Levels. Every fair value card now includes an uncertainty level that is determined by the number of valuation models used in deriving an estimate. Each estimate will be deemed to have a level of:

- Low Uncertainty when the fair value estimate is derived from > 8 valuation models.

- Medium Uncertainty when the fair value estimate is derived from 5-8 valuation models.

- High Uncertainty when the fair value estimate is derived from 3-4 valuation models.

- Very High Uncertainty when the fair value estimate is derived from < 3 valuation models.

Notice Apple’s low uncertainty, Halliburton’s medium uncertainty and Wells Fargo’s high uncertainty assigned to the estimates below.

Note that although Wells Fargo has a high uncertainty estimate, this has no connection to the certainty level of the two models that derive the estimate. The high uncertainty assignment is solely based on the number of valuation models used in calculating a stock's fair value.

We'll continue to add more reliability features like this to finbox.io as we grow and evolve. If you have any ideas, please share them with us at hi-at-finbox.io. We love hearing from our members!