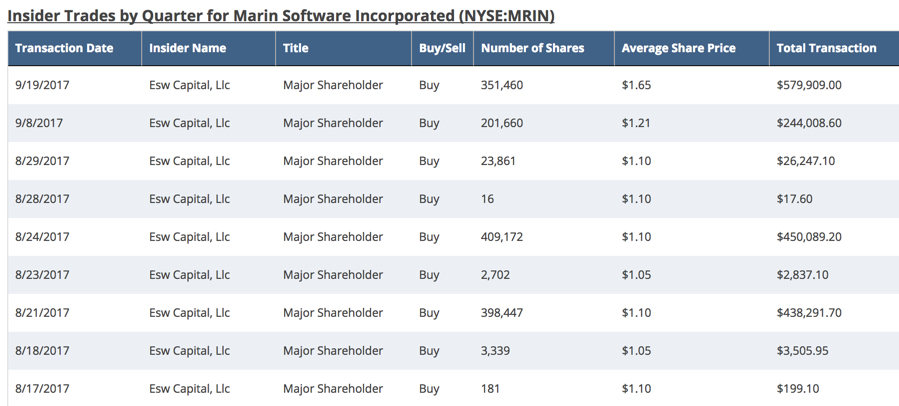

Joseph Liemandt, through ESW Capital, bought an additional 351,460 shares of Marin Software Inc. (NYSE: MRIN) on Tuesday, September 19th bringing his total ownership level to 5,074,113 shares. Mr. Liemandt now owns approximately 13% of the company.

In fact, according to Market Beat, Mr. Liemandt, again through ESW Capital, has bought roughly $1.7 million worth of stock since August 17th (approximately 2.7% of the company's market capitalization).

Marin Software's stock last traded at $1.77 as of mid-day Wednesday, September 20th, up nearly 70% over the last month and right around the time Liemandt began adding to his position.

Marin Software Incorporated operates a cross-channel advertising cloud platform that allows marketing professionals to manage their digital advertising spend across search, social, and display channels.

ESW Capital, where Mr. Liemandt is the sole voting member, is a venture capital arm of Versata, Inc. ESW Capital makes investments in business software, enterprise software, app development and managed services. Versata provides enterprise solution software that enables users to write, build and test applications. Versata caters to healthcare, financial services, and government sectors. Mr. Liemandt also happens to be the Founder and Executive Chairman of Versata Software.

Should investors expect further investment by ESW Capital? Or maybe an acquisition?

What Value Investors Need to Know

On August 28th, Marin Software management announced that its board of directors approved a reverse stock split. Chris Lien, CEO of Marin Software, added that "over the past year, the board and management have focused on putting in place initiatives to return Marin to growth while operating with financial discipline to maximize shareholder value." A special meeting is expected to be held on October 5th to obtain stockholder approval for the reverse split.

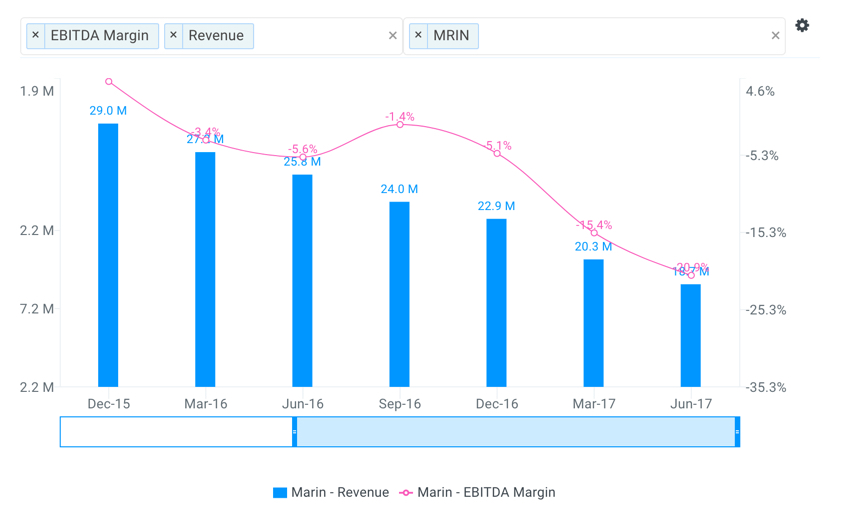

Investors will have to wait and see if Mr. Lien follows through on his promised growth. However one thing is for sure, the company has performed very poorly over the last six quarters as illustrated below.

source: finbox.io

On a quarterly basis, Marin Software's revenue has continuously trended lower. EBITDA margins have also come down from 4.2% in Q4'15 to -20.9% more recently in Q2'17.

Analysts often look at companies as either thriving, surviving or dying. Analyzing a company's growth can help distinguish between these stages. Marin Software's deteriorating revenue basis implies that its services are losing demand and/or becoming irrelevant. This helps explain why the stock is down nearly 80% over the last three years.

However, it is worth noting that shares have recently begun trading higher as a result of insider activity. There could be further upside for investors if a buyout were around the corner but tread carefully, the financial trends are not pretty.

Note this is not a buy or sell recommendation on any company mentioned.