A new filing with the SEC revealed that Praesidium Investment Management sold the majority of its Progress Software Corporation (NASDAQ: PRGS) stake over the last two months.

Praesidium Exits Progress Software

On February 14th, Praesidium Investment Management filed its quarterly Form 13F regulatory filing. The filing showed that the investment firm held 4,328,476 shares of Progress Software worth $184.3 million as of December 31st. This was also the firm's largest stock position which represented 14.3% of its listed holdings.

The following table summarizes the firm's largest holdings as of December 31st:

| Ticker | Name | Holding ($mil) | % Of Portfolio |

|---|---|---|---|

| PRGS | PROGRESS SOFTWARE CORP | $184.3 | 14.3% |

| PTC | PTC INC | $126.6 | 9.8% |

| ACN | ACCENTURE PLC IRELAND | $120.2 | 9.3% |

| AXTA | AXALTA COATING SYS LTD | $114.3 | 8.9% |

| CSOD | CORNERSTONE ONDEMAND INC | $104.3 | 8.1% |

| DOOR | MASONITE INTL CORP NEW | $94.6 | 7.3% |

| OTEX | OPEN TEXT CORP | $94.5 | 7.3% |

However, a new filing this evening revealed that the investment firm sold 4,327,479 shares worth a total of $195 million over the last two months. This reduced Praesidium's position in the company to virtually 0%.

| Transaction | Date | #Shares | Value ($) |

|---|---|---|---|

| sale | Jan 11 | 134,192 | $6,810,244 |

| sale | Jan 12 | 250,822 | $12,759,315 |

| sale | Jan 31 | 3,270 | $163,729 |

| sale | Feb 05 | 5,480 | $263,259 |

| sale | Feb 06 | 40,100 | $1,924,399 |

| sale | Feb 07 | 7,200 | $345,384 |

| sale | Feb 14 | 4,767 | $228,673 |

| sale | Feb 15 | 33,940 | $1,628,102 |

| sale | Feb 16 | 7,700 | $369,369 |

| sale | Feb 21 | 70,000 | $3,432,800 |

| sale | Feb 22 | 12,176 | $589,805 |

| sale | Mar 05 | 3,757,832 | $166,810,162 |

| TOTAL | 4,327,479 | $195,325,242 |

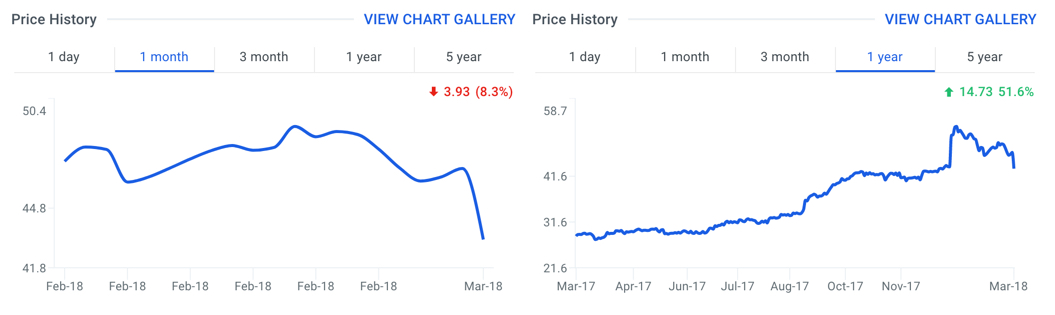

Progress Software's shares last traded at $44.41 as of Wednesday's close, down -8.3% over the last month but still up 51.6% over the last year. Could the recent selling activity signal a troubling road ahead for shareholders?

Potential Reasons For Selling Shares

According to its website, Praesidium Investment Management is a value-oriented investment management firm based in New York City. The firm's strategy consists of performing "an intense, fundamental, grassroots research process on each potential investment to identify the key long-term business drivers of the company and its industry."

Progress Software provides software solutions for various industries worldwide. It sells its products directly to end users, as well as indirectly to application partners, original equipment manufacturers, and system integrators.

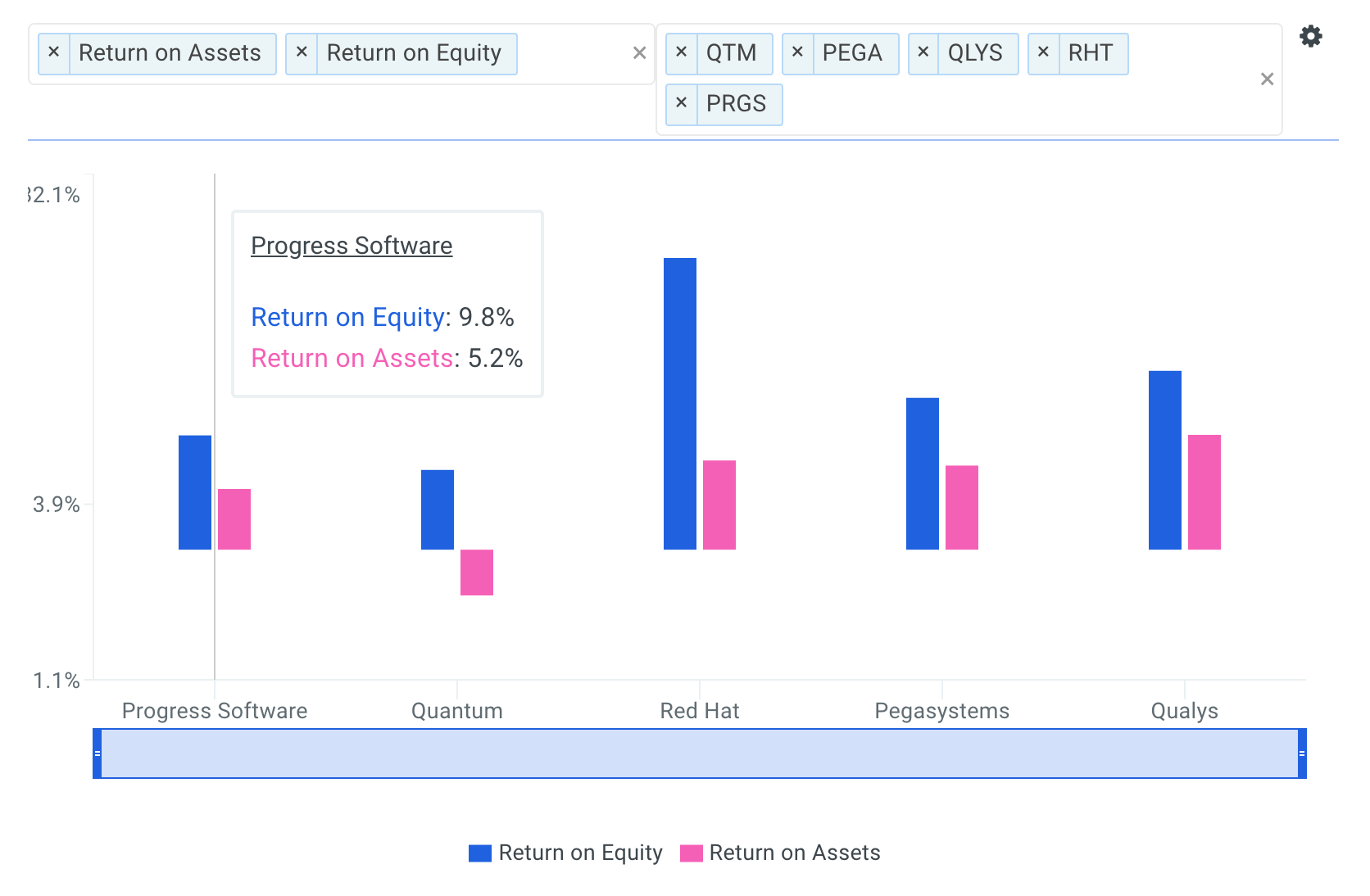

Analysts covering the stock often compare the company to a peer group that includes Quantum (NYSE: QTM), Red Hat (NYSE: RHT), Pegasystems (Nasdaq: PEGA) and Qualys (Nasdaq: QLYS). Analyzing Progress Software's financial metrics and ratios relative to this peer group offers insight into why Praesidium sold its ownership stake.

Return on Equity (ROE) measures a company's profitability in relation to the book value of Shareholders' Equity. ROE is a measure of how effectively management makes investments to generate earnings for shareholders.

The company's latest ROE of 9.8% is only above Quantum (6.8%) and below Red Hat (24.9%), Pegasystems (13.0%) and Qualys (15.3%).

source: finbox.io

Another helpful metric is Return on Assets (ROA) which represents the dollars in earnings or Net Income a company generates per dollar of assets. ROA is typically used to gauge the efficiency of the company and its management at deploying capital to generate income for shareholders. In general, a higher return on assets suggests management is utilizing the asset base efficiently. Progress Software's ROA of 5.2% is also below the majority of its peers.

In addition, the company's top-line is expected to underperform this same peer group moving forward. Projected 5-year revenue CAGR is the average annual growth rate of revenue over a five year period. It's calculated as follows:

5yr CAGR = [ Revenue FY+5 / Revenue FY ] ^ (1/5 years) - 1

The chart below plots the five-year revenue compounded annual growth rate for Progress Software and it's peers. The company's projected 5-year revenue CAGR of 0.4% is only above QTM (-1.1%) and below RHT (13.8%), PEGA (13.8%) and QLYS (13.7%).

source: finbox.io

Note that the company's historical 5-year revenue CAGR of 4.6% is also generally below its selected peers.

Finally, a number of future cash flow models imply that the stock's overvalued. The median fair value estimate of $32.16 implies -27.6% downside and is calculated from 8 separate analyses as shown in the table above. Note that each model uses consensus Wall Street estimates for the forecast when available.

| Analysis | Model Fair Value | Upside (Downside) |

|---|---|---|

| 10-yr DCF Revenue Exit | $32.39 | -27.1% |

| 5-yr DCF Revenue Exit | $31.93 | -28.1% |

| Peer Revenue Multiples | $29.41 | -33.8% |

| 10-yr DCF EBITDA Exit | $55.25 | 24.4% |

| Peer EBITDA Multiples | $60.90 | 37.2% |

| 10-yr DCF Growth Exit | $31.52 | -29.0% |

| 5-yr DCF Growth Exit | $30.41 | -31.5% |

| Peer P/E Multiples | $47.79 | 7.6% |

| Median | $32.16 | -27.6% |

Even though Progress Software shares have traded lower over the last month, the stock is still way up from its 52-low and appears to be trading at a premium to its intrinsic value. This could be a reason why Praesidium virtually exited its position in the company. The firm's analysts may have looked at similar analyses as the ones above.

Keeping an eye on the buying and selling activity of large institutional funds can help smaller investors make more informed decisions.

Author: Matt Hogan

Expertise: Valuation, financial statement analysis

Matt Hogan is a co-founder of finbox.io. His expertise is in investment decision making. Prior to finbox.io, Matt worked for an investment banking group providing fairness opinions in connection to stock acquisitions. He spent much of his time building valuation models to help clients determine an asset’s fair value. He believes that these same valuation models should be used by all investors before buying or selling a stock.

His work is frequently published at InvestorPlace, Benzinga, ValueWalk, AAII, Barron's, Seeking Alpha and investing.com.

Matt can be reached at [email protected].

As of this writing, I did not hold a position in any of the aforementioned securities and this is not a buy or sell recommendation on any security mentioned.