Cooper Companies Inc (NYSE: COO) trades at an EBITDA multiple of 19.9x, which is higher than the Healthcare sector median of 16.1x. While this makes COO appear like a stock to avoid or sell if you own it, you might change your mind after gaining a better understanding of the assumptions behind the EV/EBITDA ratio. In this article, I will break down what an EBITDA multiple is, how to interpret it and what to watch out for.

Understanding Valuation Multiples and the EV/EBITDA Ratio

A Multiples Valuation, also known as a Comparable Companies Analysis, determines the value of a subject company by benchmarking the subject's financial performance against similar public companies (Peer Group). We can infer if a company is undervalued or overvalued relative to its peers by comparing metrics like growth, profit margin, and valuation multiples.

An EBITDA Multiple, also known as Enterprise Value-to-EBITDA Multiple (EV/EBITDA), measures the dollars in Enterprise Value for each dollar of EBITDA. To determine if a company is expensive, it's far more useful to compare EV/EBITDA multiples than the absolute stock price. Furthermore, its key benefit over the P/E multiple is that it's capital structure-neutral, and, therefore, better at comparing companies with different levels of debt. The general formula behind an EBITDA Multiples valuation model is the following:

Enterprise Value = EBITDA x Selected Multiple

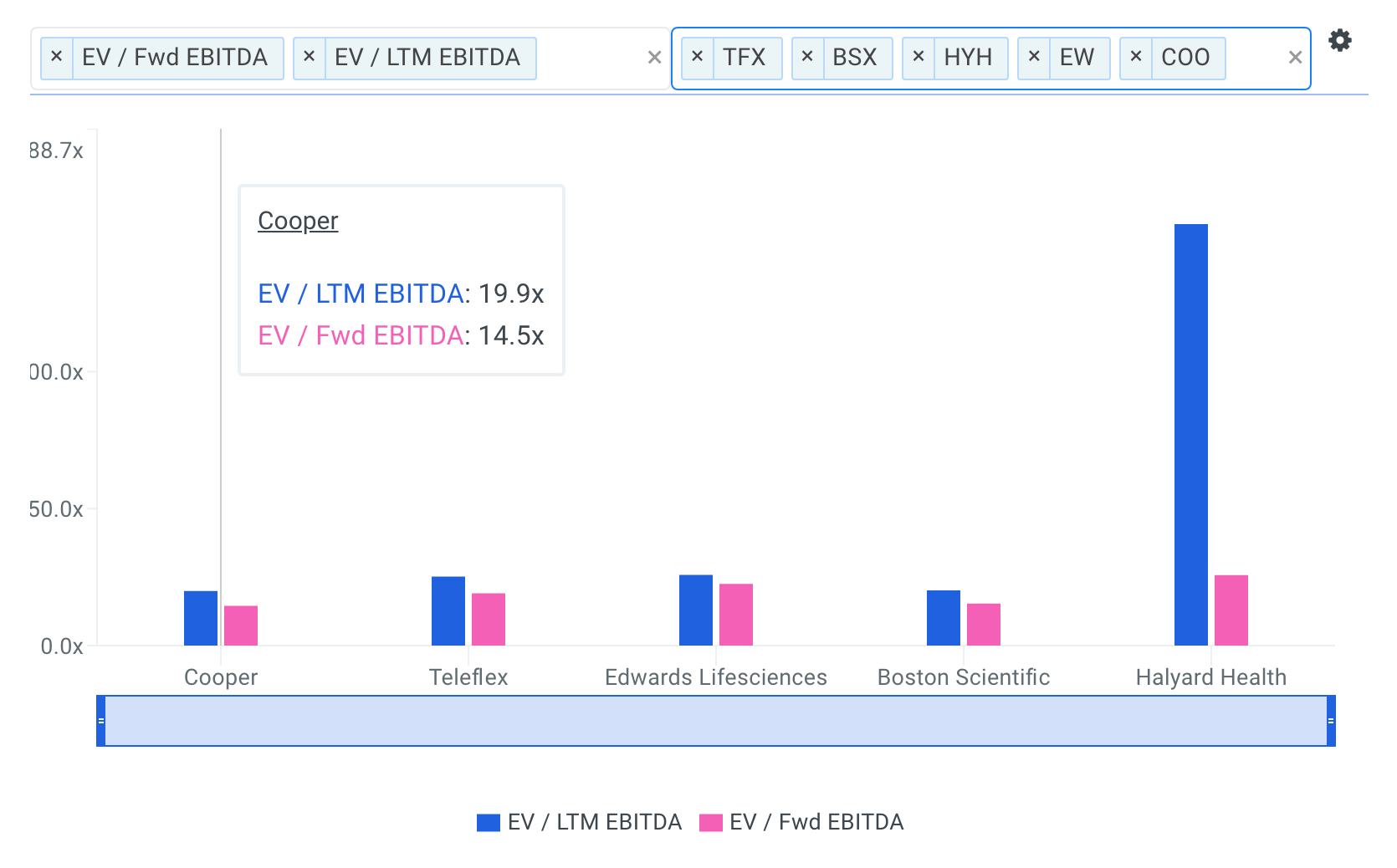

An EBITDA multiple is not meant to be viewed in isolation and is only useful when comparing it to other similar companies. Since it is expected that similar companies have similar EV/EBITDA ratios, we can come to some conclusions about the stock if the ratios are different. I compare Cooper's EBITDA multiple to those of Teleflex Incorporated (NYSE: TFX), Edwards Lifesciences Corporation (NYSE: EW), Boston Scientific Corporation (NYSE: BSX) and Halyard Health, Inc. (NYSE: HYH) in the chart below.

source: finbox.io Benchmarks: EBITDA Multiples

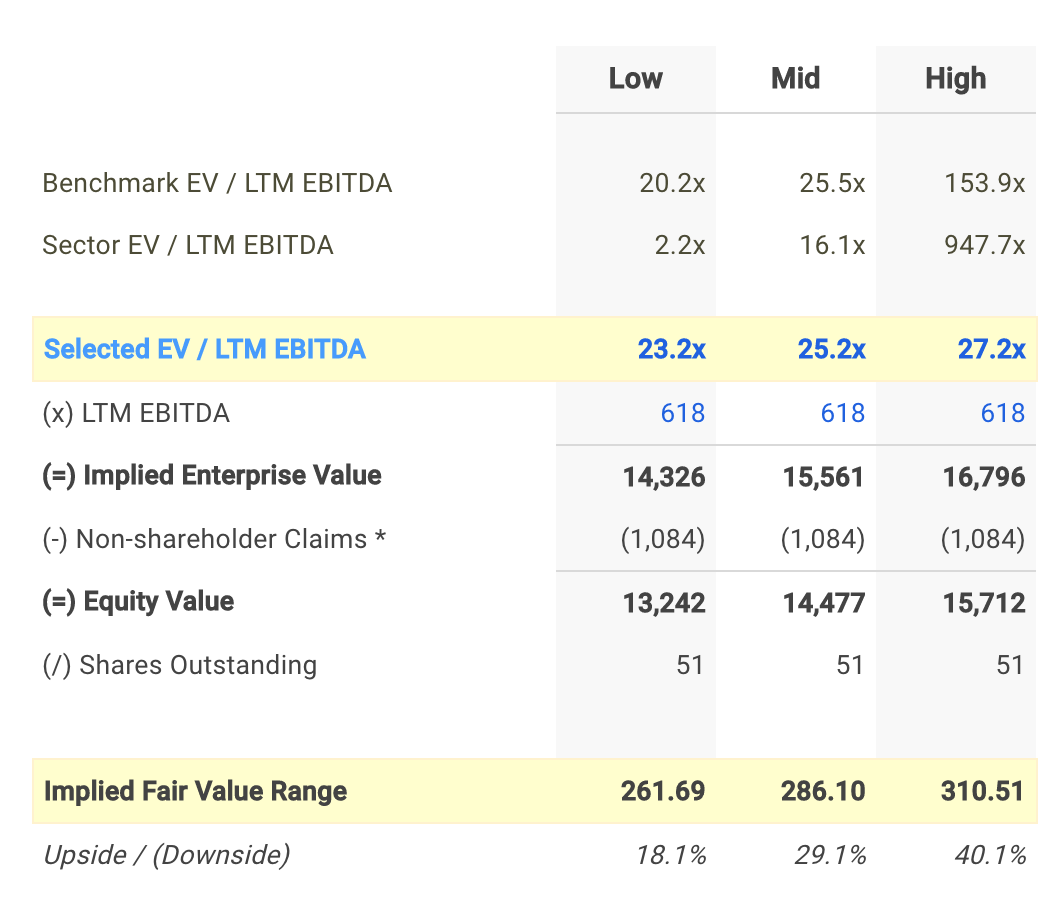

Since Cooper's EV/EBITDA of 19.9x is lower than the median of its peers (25.5x), it means that investors are paying less than they should for each dollar of COO's EBITDA. As such, our analysis shows that COO represents an undervalued stock. In fact, finbox.io's EBITDA Multiples Model calculates a fair value of $286.10 per share which implies 29.1% upside.

Note that the selected multiple of 25.2x in the analysis above was determined by taking the median of Cooper's current EBITDA multiple with its peer group.

EBITDA Multiple's Limitations

Before jumping to the conclusion that Cooper should be added to your portfolio, it is important to understand that our conclusion rests on two important assumptions.

(1) the selected peer group actually contains companies that truly are similar to Cooper, and

(2) the selected peer group stocks are being fairly valued by the market.

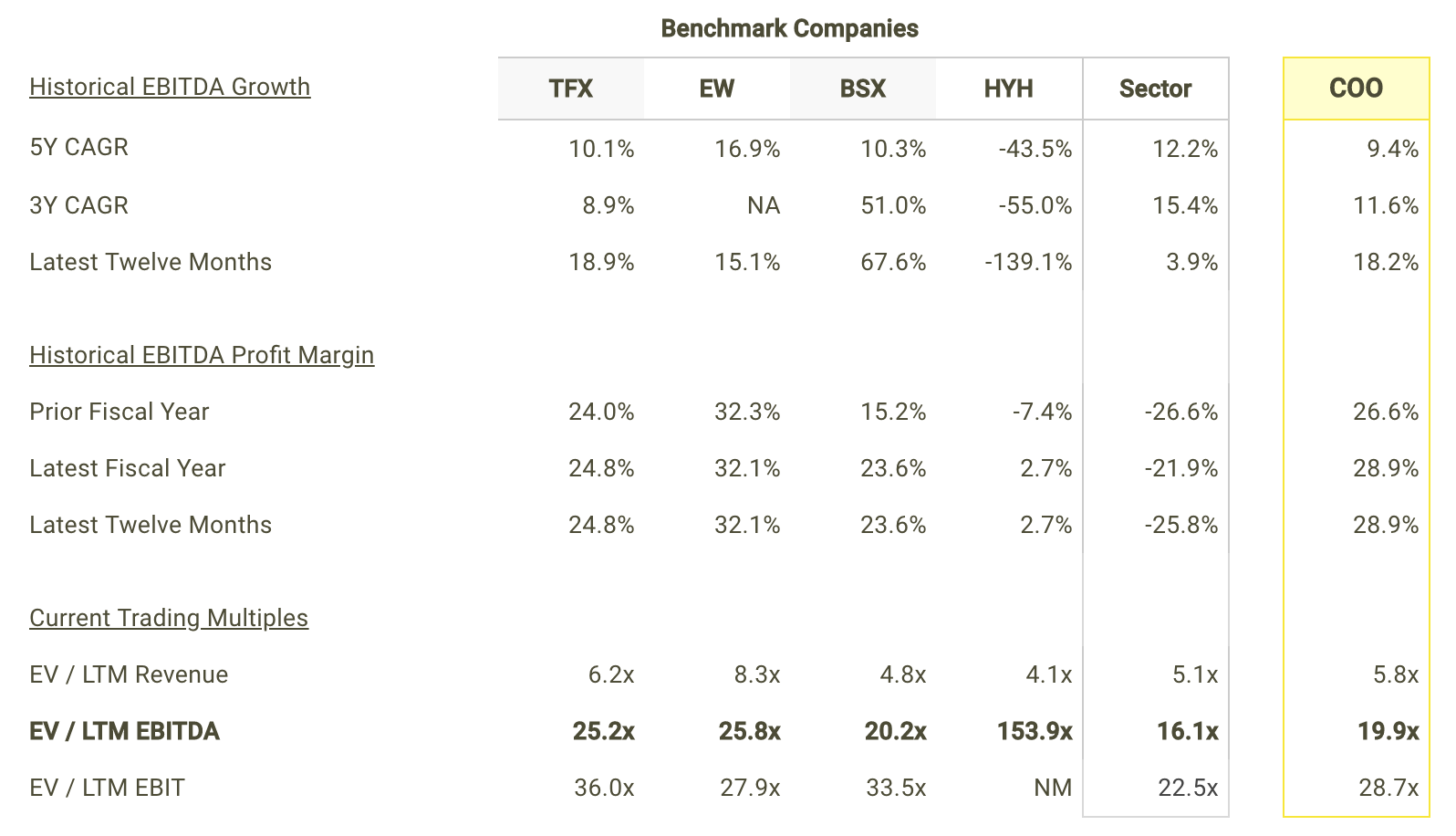

If the first assumption is not accurate, the difference in EBITDA multiples could be due to a variety of factors. For example, if you accidentally compare Cooper with higher growth companies, then its EBITDA multiple would naturally be lower than its peers since investors reward high growth stocks with a higher price.

source: EBITDA multiples model

Now if the second assumption does not hold true, Cooper's lower multiple may be because firms in our peer group are being overvalued by the market.

What This Means For Investors

As a shareholder, you may have already conducted fundamental analysis on the stock so its current undervaluation could signal a potential buying opportunity to increase your position in COO. However, keep in mind the limitations of an EBITDA multiples valuation when making an investment decision. There are a variety of other fundamental factors that I have not taken into consideration in this article. If you have not done so already, I highly recommend that you complete your research on Cooper by taking a look at the following:

Valuation Metrics: what is Cooper's EBITDA less CapEx multiple and how does it compare to its peers? This is a helpful multiple to analyze when comparing capital intensive businesses. View the company's EBITDA less CapEx multiple here.

Risk Metrics: how much interest coverage does Cooper have? This is a ratio used to assess a firm's ability to pay interest expenses based on operating profits (EBIT). View the company's interest coverage here.

Forecast Metrics: what is Cooper's projected EBITDA margin? Is the company expected to improve its profitability going forward? Analyze the company's projected EBITDA margin here.

Author: Matt Hogan

Expertise: Valuation, financial statement analysis

Matt Hogan is also a co-founder of finbox.io. His expertise is in investment decision making. Prior to finbox.io, Matt worked for an investment banking group providing fairness opinions in connection to stock acquisitions. He spent much of his time building valuation models to help clients determine an asset’s fair value. He believes that these same valuation models should be used by all investors before buying or selling a stock.

His work is frequently published at InvestorPlace, Benzinga, ValueWalk, AAII, Barron's, Seeking Alpha and investing.com.

Matt can be reached at [email protected].

As of this writing, I did not hold a position in any of the aforementioned securities and this is not a buy or sell recommendation on any security mentioned.