Q4 Earnings Season: Energy Sector Outperforming

As of Thursday January 25th, 120 companies listed in the S&P 500 index have reported their Q4'17 results according to Factset. Of these companies, 76% have reported positive EPS surprises and 81% have reported positive sales surprises (both above 5-year averages). The blended earnings growth rate for the S&P 500 in Q4'17 is expected to be 12.0% while the blended sales growth rate for the fourth quarter is expected to be 7.0%.

At the sector level, 100% of the companies in the Energy and Utilities sectors are reporting earnings above estimates. The Energy sector is also reporting the largest upside aggregate difference between actual earnings and estimated earnings (+13.1%). Furthermore, the Energy sector is easily reporting the highest YoY earnings growth of all eleven sectors at 139.1%. Note that the unusually high growth rate for the sector is mostly due to unusually low earnings in the year-ago quarter.

The market is also rewarding companies that report earnings beats. According to Factset, companies that have reported positive earnings surprises for Q4'17 have seen an average price increase of 1.4% immediately following the announcement. This percentage increase is above the 5-year average price increase of 1.2%.

Therefore I was curious to find companies that (1) are included in the energy sector, (2) have yet to report earnings, and (3) are trading at a low valuation implying that there's nice upside potential following the earnings announcement.

Screening For Energy Stocks With Big Upside

The following are all the filters applied in this energy sector stock screen.

- sector = energy

- days to next earnings is between 2 and 30

- Upside as calculated from finbox.io's fair value estimate > 15%

- Upside as calculated from consensus analyst price targets > 10%.

- Market Capitalization > $2 billion

There were only 9 companies that resulted from this stock screen as of January 29th. I then ranked them below by their blended upside potential.

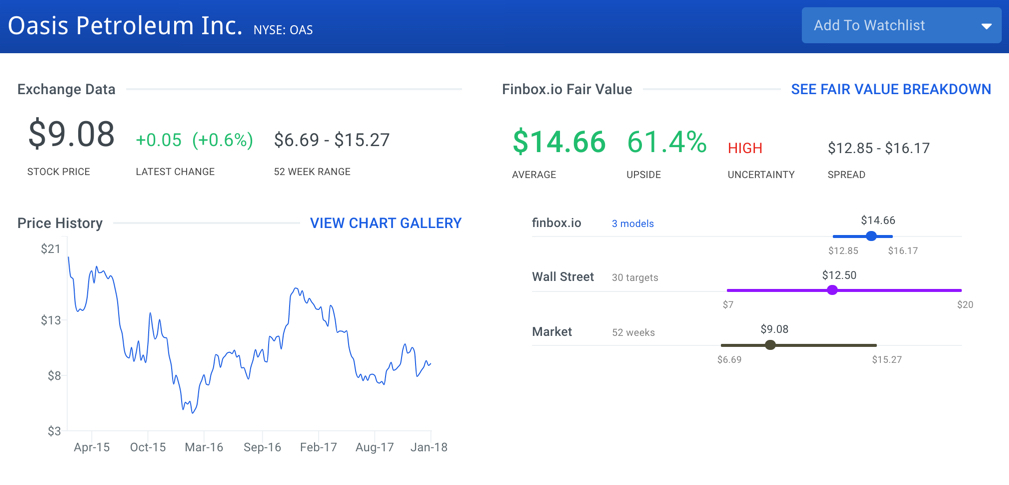

9 Best Energy Stocks To Own Before Earnings: Oasis Petroleum

Oasis Petroleum (NYSE: OAS) is an independent exploration and production company. It focuses on the acquisition and development of unconventional oil and natural gas resources in the North Dakota and Montana regions of the Williston Basin. As of December 31, 2016, the company had 517,801 net leasehold acres in the Williston Basin; and approximately 305.1 million barrels of oil equivalent reserves. The company sells its oil and natural gas to refiners, marketers, and other purchasers that have access to pipeline and rail facilities. Oasis Petroleum was founded in 2007 and is headquartered in Houston, Texas.

Shares of the company are up 7.4% over the last month. The stock last traded at $9.08 as of Monday, January 29 and three separate valuation analyses imply that there is big upside relative to its current trading price. Oasis Petroleum is estimated to report earnings on February 28.

Source: finbox.io

John Paulson is a notable investor in the company. His fund currently holds a position worth $44.3 million. Paulson is best known for his 2007 bet against the U.S. housing market where he reportedly earned over $4 billion personally on one trade. He's likely expecting outsized returns for his position in the company.

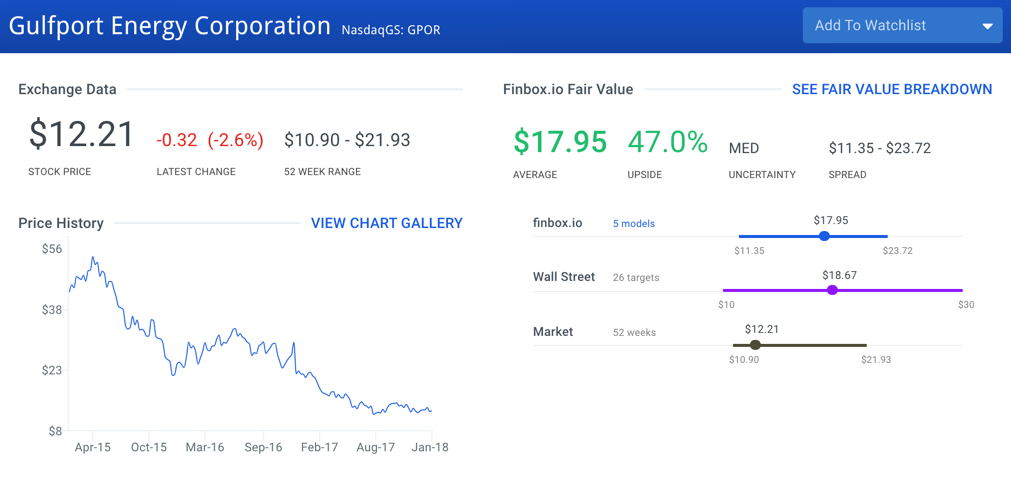

9 Best Energy Stocks To Own Before Earnings: Gulfport Energy

Gulfport Energy (NasdaqGS: GPOR) engages in the acquisition, exploration, exploitation, and production of natural gas, natural gas liquids (NGLs), and crude oil in the United States. Its principal properties are located in the Utica Shale primarily in Eastern Ohio, along with the Louisiana Gulf Coast in the West Cote Blanche Bay, and Hackberry fields. The company also has interests in Northwestern Colorado, Canada, and Thailand. The company was founded in 1997 and is headquartered in Oklahoma City, Oklahoma.

Shares of Gulfport Energy are down -1.8% over the last month and finbox.io's fair value estimate of $17.95 per share calculated from 5 cash flow models imply 47.0% upside. The average price target from 26 Wall Street analysts of $18.67 per share similarly imply big upside.

Gulport Eneregy is expected to reported earnings on February 12.

Source: finbox.io

It is also important to note that fund manager David Dreman is currently long the stock as revealed in his firm's most recent 13F filing. Dreman, founder and Chairman of Dreman Value Management, is best known for his contrarian value investing strategy. His published research has proven that out of favor stocks significantly outperform stocks considered to have more favorable outlooks. He obviously expects shares of Gulfport Energy to outperform going forward.

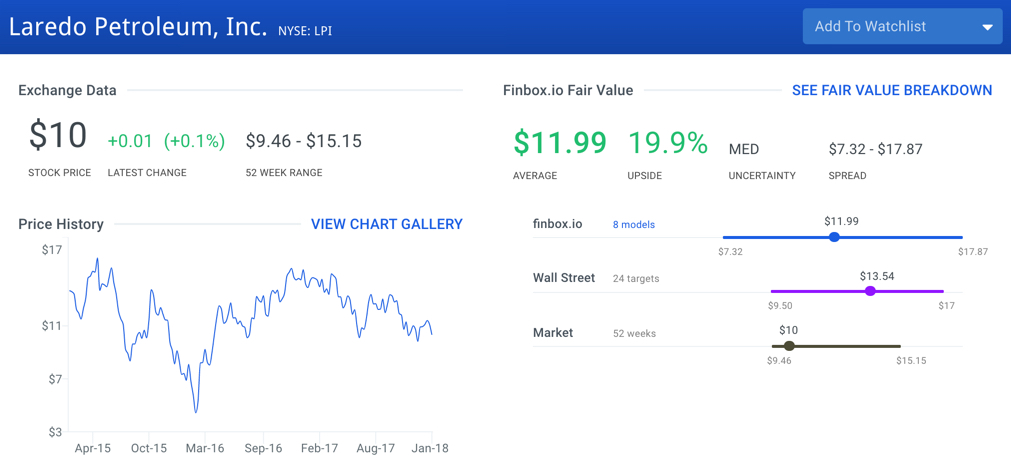

9 Best Energy Stocks To Own Before Earnings: Laredo Petroleum

Laredo Petroleum (NYSE: LPI) operates as an independent energy company in the United States. It focuses on the acquisition, exploration, and development of oil and natural gas properties; and the transportation of oil and natural gas primarily in the Permian Basin in West Texas. As of December 31, 2016, it had assembled 127,847 net acres in the Permian Basin; and had total proved reserves of 167,100 thousand barrels of oil equivalent. Laredo Petroleum was founded in 2006 and is headquartered in Tulsa, Oklahoma.

The company is estimated to report earnings on February 21.

Source: finbox.io

Laredo Petroleum's stock currently trades at $10.00 per share as of Monday January 29, down -5.8% over the last month. Finbox.io's eight valuation analyses suggest that shares could increase 19.9% going forward.

It's worth noting that highly followed portfolio manager Steven Cohen currently holds a position in Laredo Petroleum worth $52.3 million. He was the third highest-earning hedge fund manager of 2012 when he made $1.4 billion. No doubt Cohen is expecting big gains from his long position in Laredo Petroleum.

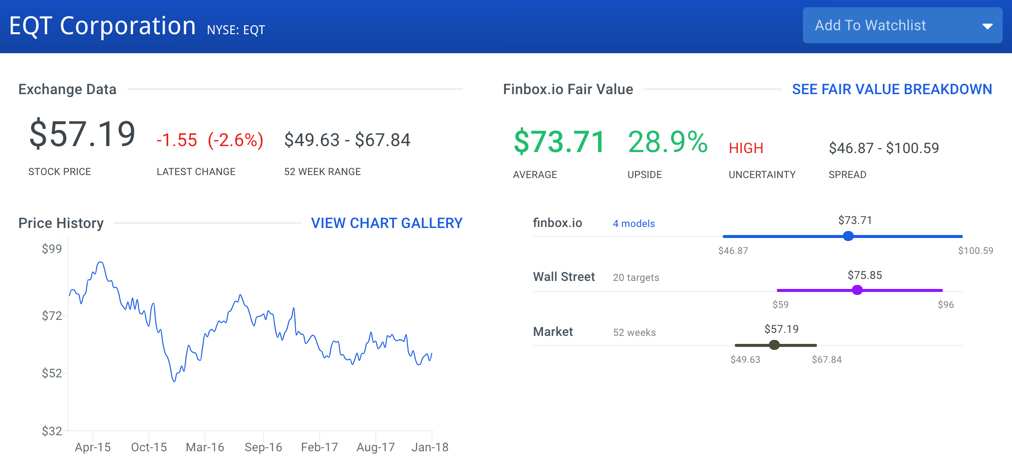

9 Best Energy Stocks To Own Before Earnings: EQT Corp

EQT Corp (NYSE: EQT) operates as an integrated energy company in the United States. The company operates through three segments: EQT Production, EQT Gathering, and EQT Transmission. The EQT Production segment engages in the exploration and production of natural gas and crude oil primarily in the Appalachian Basin. The EQT Gathering is involved in natural gas gathering activities. As of December 31, 2016, this segment operated approximately 300 miles of high-pressure gathering lines with approximately 1.8 billion cubic feet of total gathering capacity. The EQT Transmission segment engages in natural gas transmission and storage activities. As of December 31, 2016, this segment operates a 950-mile pipeline that connects to six interstate pipelines and multiple distribution companies. EQT Corp was founded in 1925 and is headquartered in Pittsburgh, Pennsylvania.

Shares of the company are trading 3.2% higher month over month while the stock price could end up trading 28.9% higher in 2018 based on EQT Corp's future cash flow projections. The company is expected to report earnings on February 15 before the market opens.

Source: finbox.io

Illustrious money manager George Soros currently owns 1,344,834 shares of EQT which represents 2.8% of his stock portfolio. Soros is considered "the man who broke the Bank of England" after taking on the central bank in a trade that earned him over $1 billion.

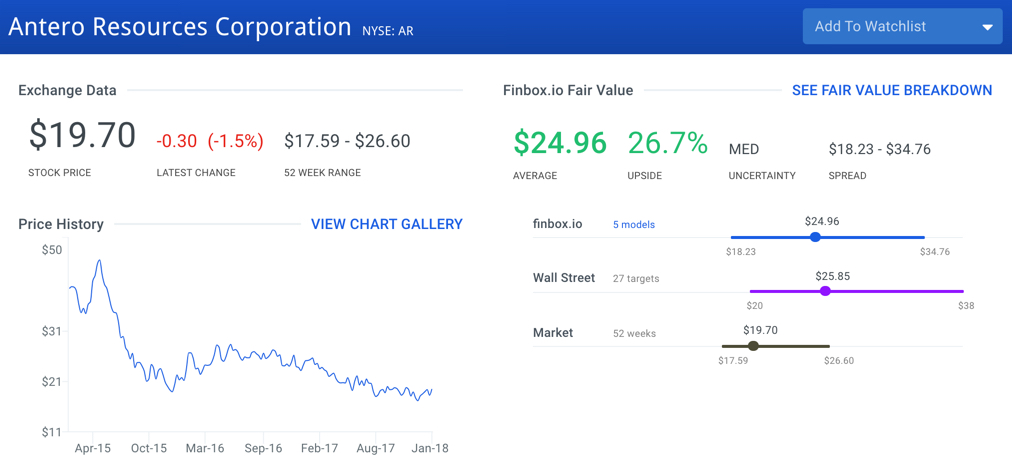

9 Best Energy Stocks To Own Before Earnings: Antero Resources

Antero Resources Corp (NYSE: AR) is an independent oil and natural gas company that explores, produces, and develops natural gas and oil properties in the United States. As of December 31, 2016, the company had 616,000 net acres of oil and gas properties located in the Appalachian Basin in West Virginia, Ohio, and Pennsylvania. It also owned and operated 213 miles of gas gathering pipelines. Antero Resources Corp was founded in 2002 and is headquartered in Denver, Colorado.

Antero Resources Corp's stock last traded at $19.70 per share as of Monday January 29, up 5.3% over the last month. On a fundamental basis, the company's stock is trading at a 26.7% discount to finbox.io's intrinsic value estimate. Antero Resources Corp is expected to report earnings on February 13 after the market closes.

Source: finbox.io

Widely respected investor Seth Klarman currently owns shares of Antero Resources Corp worth $475.9 million (6.2% of his portfolio). Klarman is the CEO & President of the Boston based Baupost Group which managed $30 billion as of December 2016. Klarman, along with Warren Buffett, is regarded as one of the most successful value investors in the world and likely enjoys Antero Resources Corp's large margin of safety.

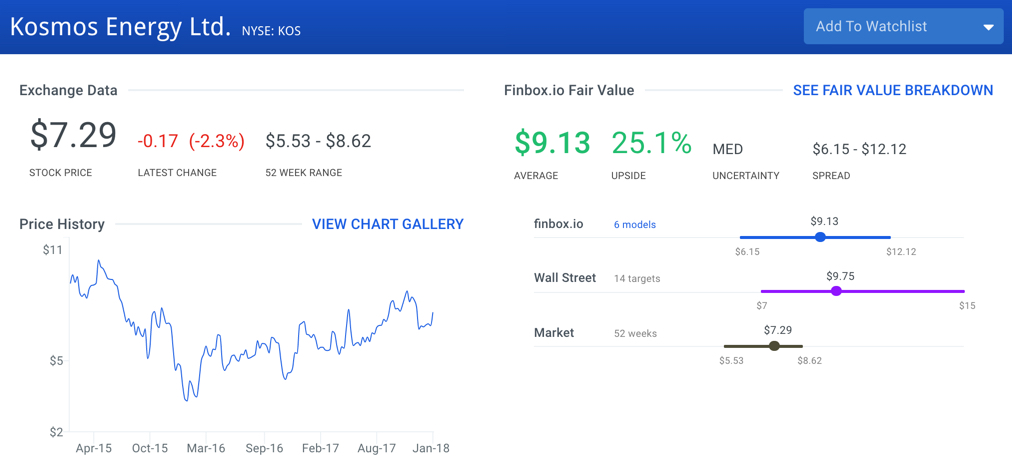

9 Best Energy Stocks To Own Before Earnings: Kosmos Energy

Kosmos Energy (NYSE: KOS) explores for and produces oil and gas in Africa and South America. Its asset portfolio includes production and other development projects in offshore Ghana, as well as exploration licenses offshore Sao Tome and Principe, Suriname, Morocco, and Western Sahara. The company was founded in 2003 and is based in Hamilton, Bermuda.

Source: finbox.io

Shares of the company are up 9.1% over the last month. The stock last traded at $7.29 as of Monday January 29 and six separate valuation analyses imply that there is 25.1% upside relative to its current trading price. The consensus price target of $9.75 per share calculated from 14 Wall Street analysts implies even further upside. Kosmos Energy is expected to report earnings on February 26.

9 Best Energy Stocks To Own Before Earnings: Noble Energy

Noble Energy (NYSE: NBL) is an independent energy company that engages in the acquisition, exploration, development, and production of crude oil and natural gas worldwide. Its principal projects are located in the United States, deepwater Gulf of Mexico, Eastern Mediterranean, and West Africa. As of December 31, 2016, the company had approximately 1,437 million barrels oil equivalent of total proved reserves. Noble Energy was founded in 1932 and is headquartered in Houston, Texas.

Source: finbox.io

Shares of Noble Energy are up 11.7% over the last month and finbox.io's fair value estimate of $43.07 per share calculated from five cash flow models imply 32.7% upside. The average price target from 29 Wall Street analysts of $38.24 per share similarly imply upside. Noble Energy is expected to report earnings on February 20 before the market opens.

Steven Cohen also owns shares of Noble Energy worth $94.0 million.

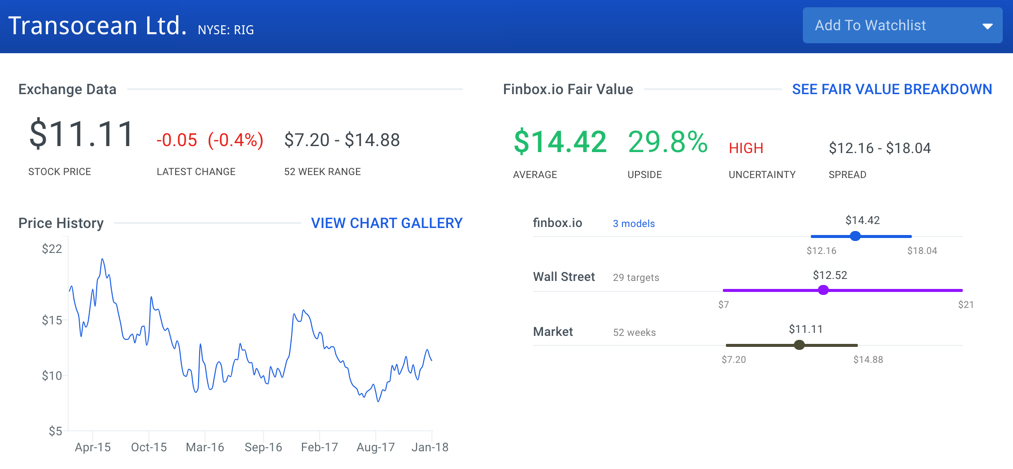

9 Best Energy Stocks To Own Before Earnings: Transocean

Transocean (NYSE: RIG) provides offshore contract drilling services for oil and gas wells worldwide. The company primarily offers deepwater and harsh environment drilling services. As of February 9, 2017, it owned or had partial ownership interests in, and operated 56 mobile offshore drilling units. The company serves government-controlled oil companies and independent oil companies and was founded in 1953.

Transocean is expected to report earnings on February 20 after the market closes.

Source: finbox.io

Transocean's stock currently trades at $11.11 per share as of Monday January 29, up 4.5% over the last month. Finbox.io's three valuation analyses suggest that shares could increase 29.8% going forward.

9 Best Energy Stocks To Own Before Earnings: Newfield Exploration

Newfield Exploration (NYSE: NFX) engages in the exploration, development, and production of crude oil and natural gas in the United States. The company’s principal areas of operation include the Anadarko and Arkoma basins of Oklahoma, the Williston Basin of North Dakota, and the Uinta Basin of Utah. It also holds oil producing assets offshore China. The company was founded in 1988 and is headquartered in The Woodlands, Texas.

Ray Dalio is a notable investor in the company. His fund currently holds a position worth $12.0 million. Dalio is the billionaire investor that founded Bridgewater, one of the largest hedge funds on Wall Street. His hedge fund was likely attracted by Newfield Exploration's strong fundamentals.

Source: finbox.io

Shares of the company are trading 7.7% higher month over month. The stock price could end up trading another 21.7% higher in 2018 based on Newfield Exploration's future cash flow projections. Newfield Exploration is expected to report earnings on February 20 after the market closes.

9 Best Energy Stocks To Own Before Earnings

In conclusion, the table below highlights all nine stocks and their upside potential.

| Ticker | Name | Upside (finbox.io) | Upside (Analyst Target) | Blend Upside |

|---|---|---|---|---|

| OAS | Oasis Petroleum | 61.4% | 38.4% | 49.9% |

| GPOR | Gulfport Energy | 47.0% | 49.0% | 48.0% |

| LPI | Laredo Petroleum | 19.9% | 35.5% | 27.7% |

| EQT | EQT Corp | 28.9% | 29.1% | 29.0% |

| AR | Antero Resources Corp | 26.7% | 29.3% | 28.0% |

| KOS | Kosmos Energy | 25.1% | 30.5% | 27.8% |

| NBL | Noble Energy | 32.7% | 17.5% | 25.1% |

| RIG | Transocean | 29.8% | 12.2% | 21.0% |

| NFX | Newfield Exploration | 21.7% | 14.7% | 18.2% |

Earnings season is an exciting time. Investors are provided with buying and selling opportunities as the majority of publicly traded companies release their results for the fourth quarter of 2017.

If the first two weeks of the Q4'17 earnings season is any indicator of how the energy sector is going to perform, value investors may want to take a closer look at these stocks prior to earnings. They all appear to be trading well below their intrinsic values.

As of this writing, I did not hold a position in any of the aforementioned securities and this is not a buy or sell recommendation on any security mentioned.

image source: Kiplinger

Author: Matt Hogan

Expertise: Valuation, financial statement analysis

Matt Hogan is a co-founder of finbox.io. His expertise is in investment decision making. Prior to finbox.io, Matt worked for an investment banking group providing fairness opinions in connection to stock acquisitions. He spent much of his time building valuation models to help clients determine an asset’s fair value. He believes that these same valuation models should be used by all investors before buying or selling a stock.

His work is frequently published at InvestorPlace, Benzinga, ValueWalk, AAII, Barron's, Seeking Alpha and investing.com.

Matt can be reached at [email protected].