Want to know what CF Industries (CF), Pfizer (PFE) and Cedar Fair (FUN) all have in common? I’ll keep it simple. All three stocks have:

- A dividend yield of 3.5% or more

- Grown its dividends per share for each of the last 5 years

- An interest coverage ratio of 4.0x or more (ample cash flow to cover debt obligations)

- A consensus “Buy” rating from Wall Street

- And a fair value upside of 20% or more

These stocks all offer a quality yield, dividend growth and huge upside potential. Let's take a closer look.

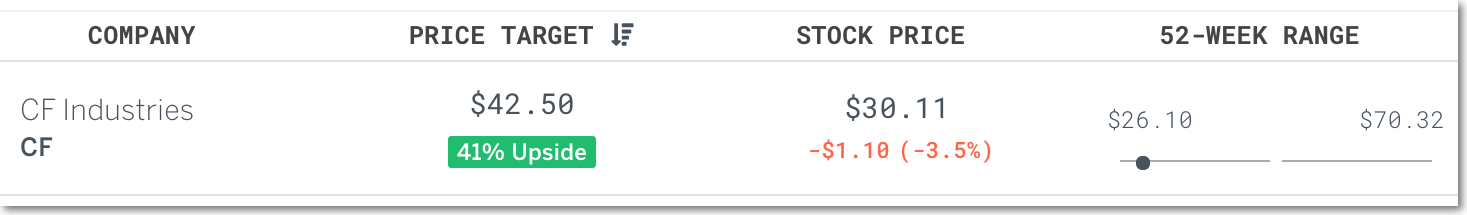

CF Industries (CF)####

CF Industries is one of the largest manufacturers and distributors of fertilizer products in the world and the largest nitrogen fertilizer producer in North America. The company paid out a total of $69 million in dividends in 2011 which increased to $282 million in 2015. That represents a compounded annual growth rate of 33%. Furthermore, CF’s payout ratio is still well below 50% meaning more dividends to come! What’s also attractive about this dividend grower is its upside potential as shown in my Discounted Cash Flow "DCF" analysis below:

Yes, the stock has lost almost 50% of its value over the last year mainly because Free Cash Flow "FCF" was negative in 2015 and concern over the company's total debt balance mounted. However, the negative FCF was due to non-recurring capex spend related expansion projects. Capex will be dropping considerably by 2017 and CF Industries will then be generating FCF in excess of $1 billion.

In addition, interest coverage still stands at almost 10.0x meaning the company won't have any problems covering its debt obligations. This one could pop to $40 when FCF starts showing signs of improvement.

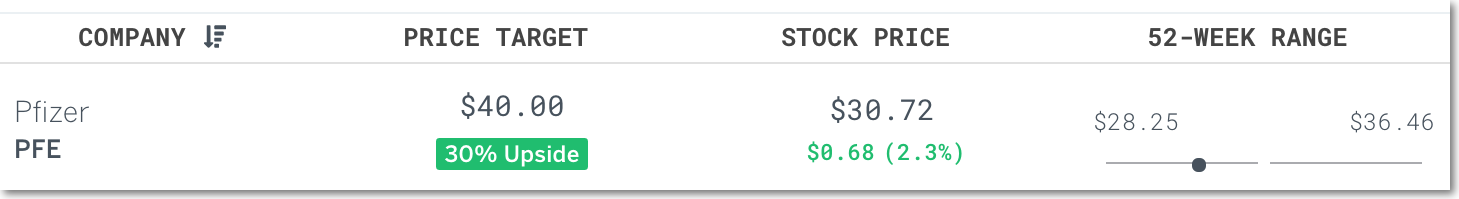

Pfizer (PFE)####

While I was in the process of writing this, David Faber reported that Pfizer and Allergan (AGN) will be terminating their $190 billion merger deal due to tax inversion regulations. The deal announced back in November was originally expected to close by the second half of the year. However, Pfizer will now pay a termination fee of $400 million which is a small amount that won't impact its valuation.

The DCF below represents Pfizer Stand Alone using Management’s conservative estimates. The stand alone business still shows significant upside.

In addition, over the last 5 years Pfizer has increased its dividends per share like clockwork ranging from 8%-11%.

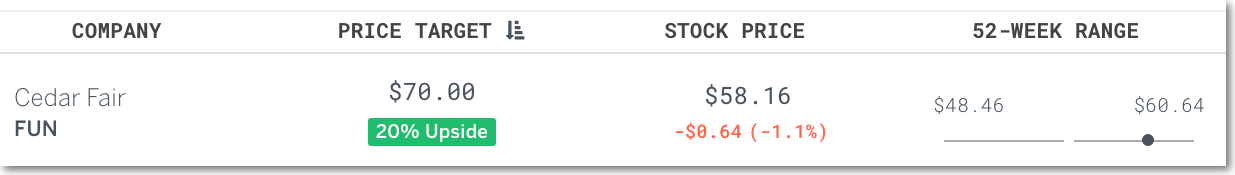

Cedar Fair (FUN)####

Credit Suisse highlights Cedar Fair's growth outlook in their recent OUTPERFORM rating:

“Management has had great success with its expansion of Carowinds, and will expand other parks including Valleyfair and Great America this year. Additionally, a sports complex development should help to bolster already strong visitation trends at Cedar Point. Given these initiatives and others, we believe FUN will have a strong runway for ticket price and in-park pricing growth in 2016.”

In late January, Goldman Sachs upgraded Cedar Fair to a "Conviction Buy" rating with a $69 price target when the stock was trading in the low $50s. Now a few months later the stock is in the upper $50s. I see no reason the $69 fair value target won't be realized. The new initiatives with attached revenue streams and margin expansion will continue to propel shares upward.

Cedar Fair has the lowest ceiling of the 3 dividend payers mentioned in this article but enjoys the highest yield that currently stands above 5.5%. A high dividend yield is always a nice add to your total return!

A buy and hold strategy for these top dividend stocks is a good way to boost your portfolio's return. All three stocks continue to raise their payouts every year, offer high yields and have considerable upside potential. I recommend taking a closer - especially if you’re dividend hunting.