ABB Ltd (NYSE: ABB) is currently paying investors an above average dividend yield of 3.7% while the Industrials sector median stands 1.5%. Even though this makes ABB look attractive relative to its peers, it's useful to understand the company's future dividend potential. Will ABB's bottom line be the main catalyst driving future growth or maybe its payout ratio? Understanding these components and how they impact value may change your mind on the company's future prospects.

Is A Dividend Analysis Appropriate?

A Dividend Discount Model (DDM) is a way of valuing a company based on the theory that a stock is worth the discounted sum of all of its future dividend payments.

However, before walking through my dividend analysis for ABB, it's first helpful to determine if this is actually an appropriate technique to be used when estimating its fair value. Many analysts are often biased towards one specific valuation approach which is typically a mistake that can negatively impact investment decisions and result in trading losses or missed opportunities. Every company has unique characteristics that may require you to adjust your analysis.

Understanding leverage trends is the first step when determining what valuation analyses are relevant for a given company. When a company's leverage doesn’t fluctuate or is expected to remain stable over time, then an equity valuation model (e.g. equity DCF, DDM) will be the most appropriate valuation technique. The reason for this is because when leverage is stable, interest expense on debt can typically be projected with much more reliability.

How do we check if a company's leverage has been fluctuating or is expected to do so? This isn't always straightforward but checking recent debt ratio trends can be a good indicator. ABB's debt to equity ratio has stayed relatively stable over last few years hitting a low of 48.5% in December 2017 and a high of 49.6% in December 2015. This suggests that an equity valuation model is a suitable technique when valuing the company's shares. Now does it make sense to use a dividend discount model knowing that an equity valuation technique is an appropriate methodology?

We now must determine if ABB pays a dividend and if so, is its payout ratio relatively high (typically above 75%)? This helps figure out if the company distributes the majority of its profits to shareholders in the form of dividends.

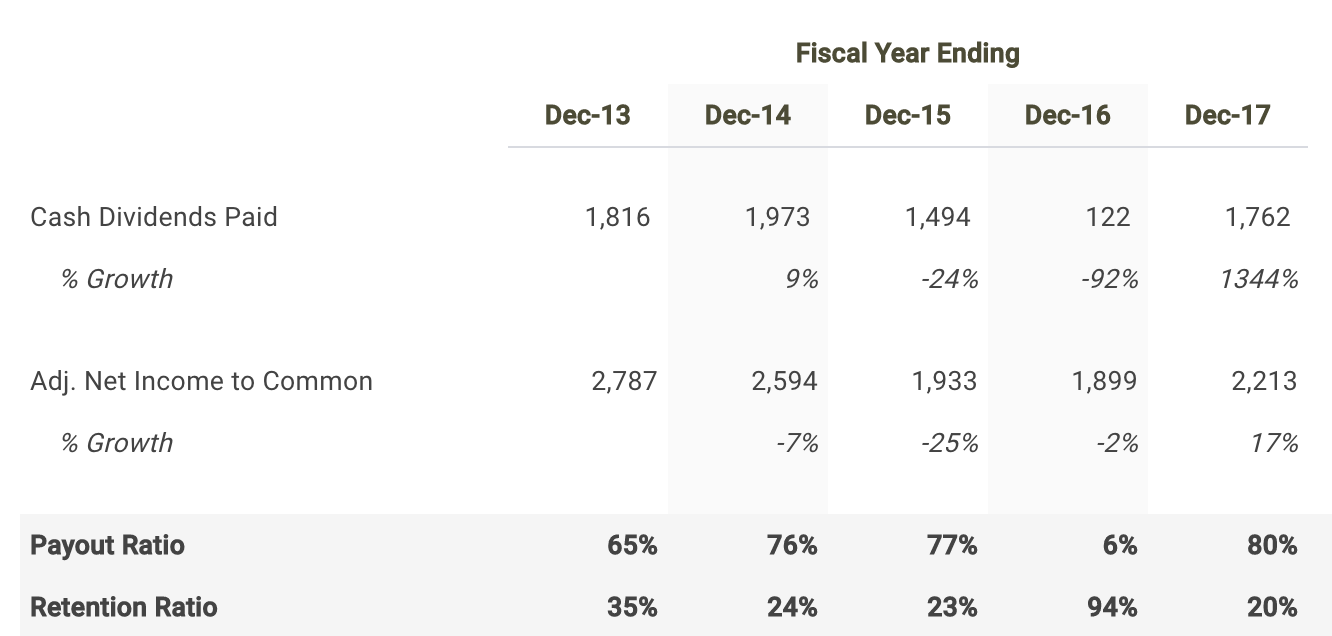

Source: ABB dividend discount model

ABB paid out a total of $1,762 million in cash dividends to shareholders in its most recent fiscal year Dec-17 representing a payout ratio of 79.6%. Therefore, it is fitting to use a dividend discount model when calculating the intrinsic value of ABB stock.

How To Project ABB's Dividends

Since forecasting dividends directly can be difficult, the first step in building a dividend discount model is to project net income. So let's create a net income forecast for the next five years and use that as the basis for our future dividends.

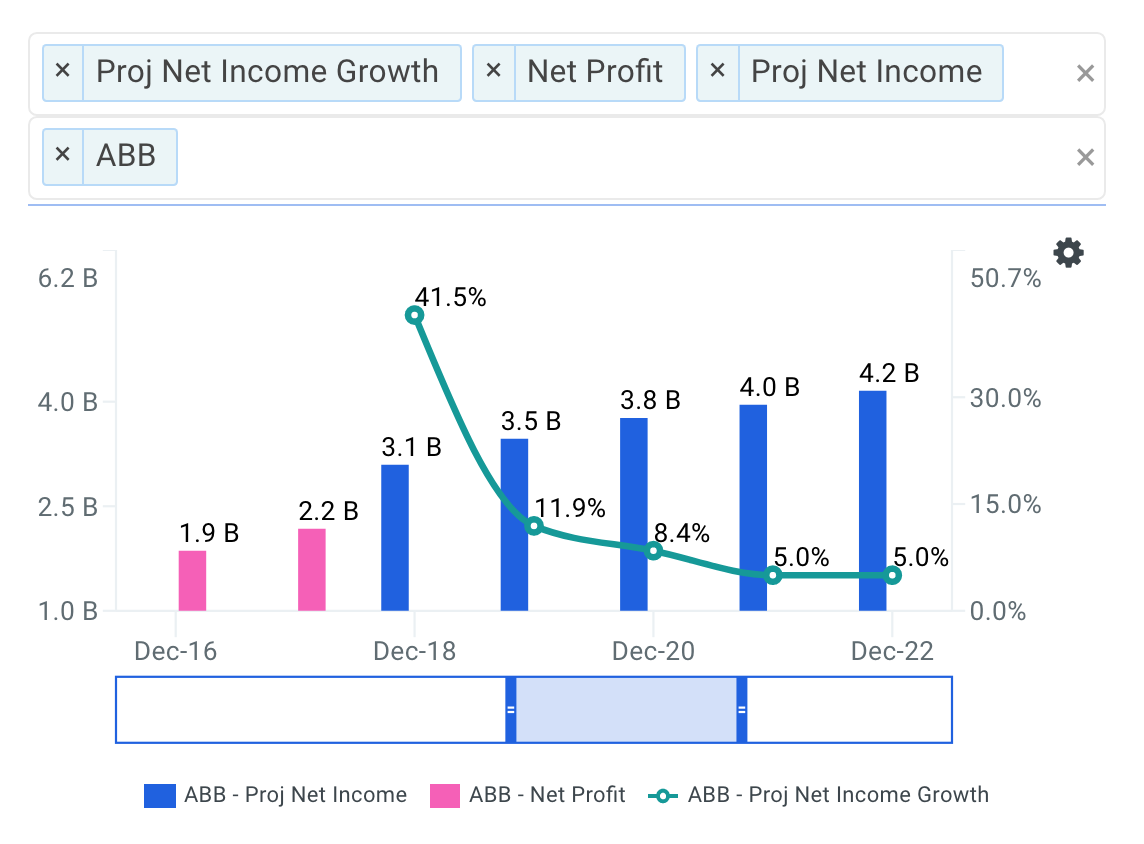

Applying consensus estimates, Wall Street is projecting a healthy growth rate in the company's bottom-line over the next five years. Net income is expected to grow at an average annual rate of 14% bringing net income to $4,192 million by fiscal year 2022.

Source: ABB Projected Net Income Growth

I apply the net profit estimates above to drive my dividend forecast. The next step is to project the company's payout ratio. In my estimates shown in the table below, I select a 76.0% payout ratio in 2018 and hold it steady there throughout my projection period.

Source: ABB dividend discount model

Discounting ABB's Future Dividends

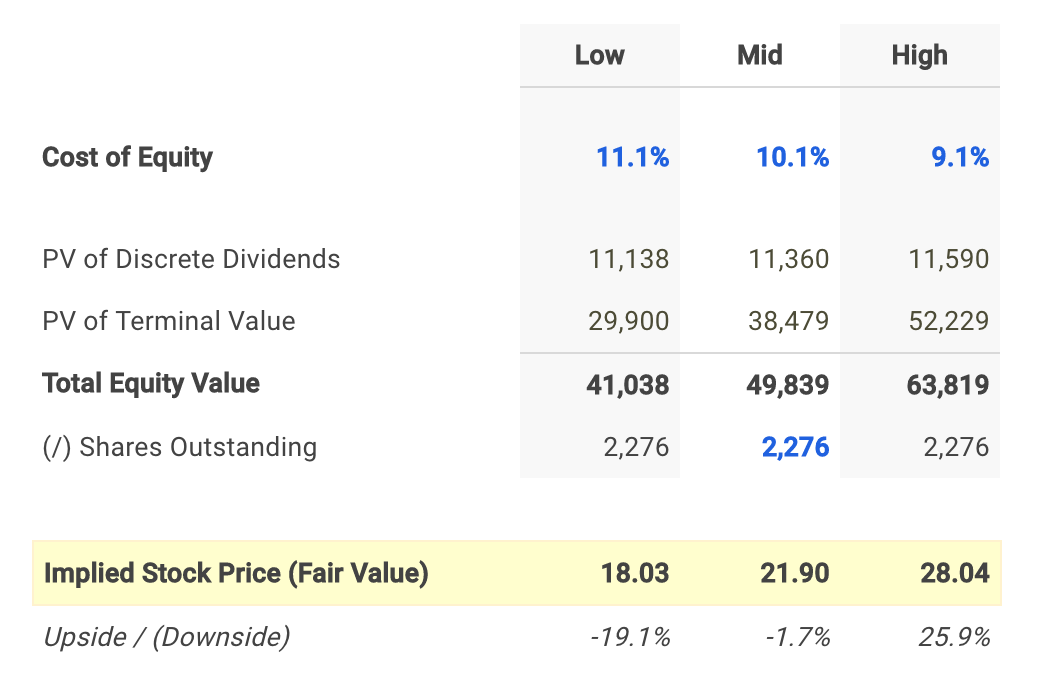

The final step is to present value the forecasted dividend distributions using a discount rate. I used finbox.io’s Weighted Average Cost of Capital (WACC) model to help arrive at an estimate for the company's cost of equity.

I concluded a reasonable cost of equity for the company to be 10.1% at the midpoint. Although I don't walk you through the CAPM assumptions that got me there, you can view the calculations using real-time data at finbox.io's ABB WACC model page.

In conclusion, my dividend discount model calculates a fair value per share for ABB of $21.90, -1.6% below its current stock price of $22.70. As a result, investors may conclude that they want to hold off on purchasing shares until the stock develops a wider margin of safety.

What This Means For Investors

An important component of the dividend discount model that investors should understand is that the technique will inherently undervalue a stock. This is typically the result of the payout ratio assumption being less than 100% implying some cash leakage. Meaning the approach does not capture value that would otherwise build up as cash on the balance sheet. In practice, this excess retained cash is usually paid out to shareholders as special dividends or to make up for cash shortfalls for future dividends during economic downturns.

Understanding that this approach calculates a conservative fair value estimate may be a promising sign for investors looking to purchase shares or add to an existing position. Since ABB looks to be trading near its intrinsic value based on the analysis above, this could actually represent a 'downside' case meaning an 'upside' case could have a much larger margin of safety.

Although a dividend discount model on its own is not necessarily indicative of a stock's fair value, it does offer a number of useful insights. This valuation should only be the start of your analysis in relation to your total research. I recommend that you continue your review of ABB to gain a better understanding of its underlying fundamentals.

Author: Andy Pai

Expertise: financial modeling, mergers & acquisitions

Andy is also a founder at finbox.io, where he's focused on building tools that make it faster and easier for investors to do investment research. Andy's background is in investment banking where he led the analysis on over 50 board advisory engagements involving mergers and acquisitions, fairness opinions and solvency opinions. Some of his board advisory highlights:

- Sears Holdings Corp.'s $620 mm spin-off via rights offering of Sears Outlet, Hometown Stores and Sears Hardware Stores.

- Cerberus Capital Management's $3.3 bn acquisition of SUPERVALU Inc.'s New Albertsons, Inc. assets.

Andy can be reached at [email protected].

As of this writing, I did not hold a position in any of the aforementioned securities and this is not a buy or sell recommendation on any security mentioned.