United Technologies Corporation's (NYSE: UTX) most recent return on equity was an above average 15.0% in comparison to the Industrials sector which returned 10.1%. Though UTX's performance over the past twelve months is impressive, it's useful to understand how the company achieved its healthy ROE. Was it a result of profit margins, operating efficiency or maybe even leverage? Knowing these components may change your views on UTX and its future prospects.

ROE Trends Of UTX

Return on equity (ROE) is the amount of net income returned as a percentage of shareholders equity. It is calculated as follows:

ROE = Net Income To Common / Average Total Common Equity

ROE is a helpful metric that illustrates how effective the company is at turning the cash put into the business into gains or returns for investors. But it is important to note that ROE can be impacted by management's financing decisions such as the deployment of leverage.

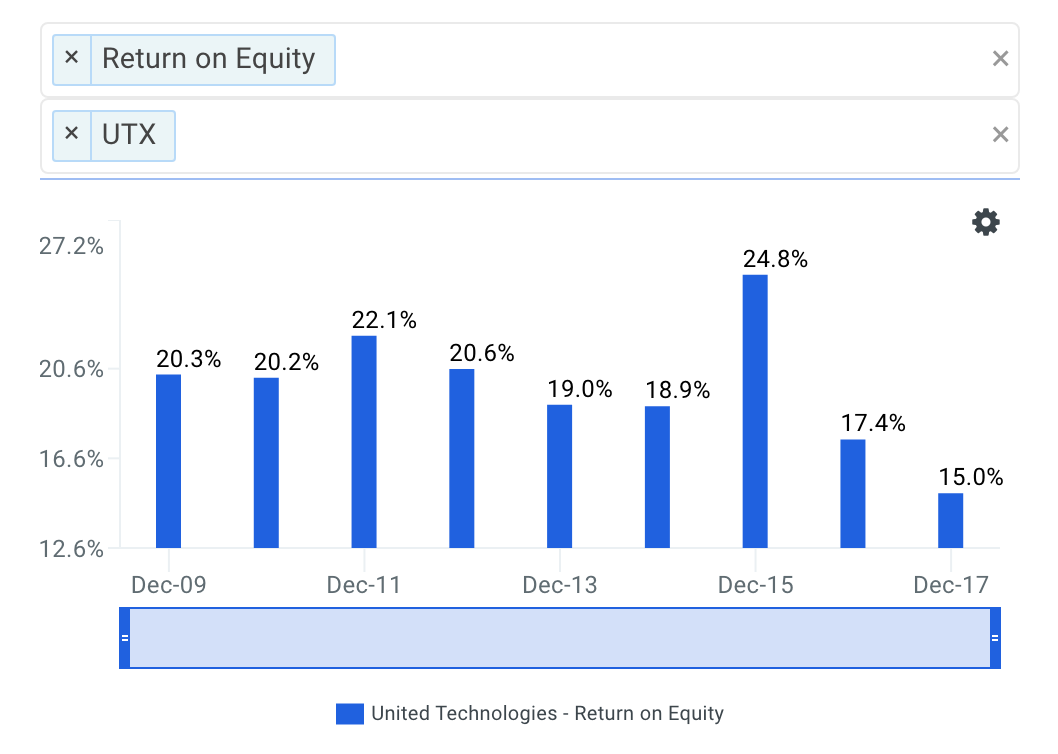

The return on equity of UTX is shown below.

source: finbox.io data explorer - ROE

Unfortunately for shareholders, UTX's return on equity has decreased each year since 2015. ROE decreased from 24.8% to 17.4% in fiscal year 2016, decreased to 15.0% in 2017 and the LTM period is also its latest fiscal year. So what's causing the steady decline?

UTX's Declining ROE Trends

In addition to the formula previously discussed, there's actually another way to calculate ROE. It's often called the DuPont formula and is as follows:

Return on Equity = Net Profit Margin * Asset Turnover * Equity Multiplier

Analyzing changes in these three items over time allows investors to figure out if operating efficiency, asset use efficiency or the use of leverage is what's causing changes in ROE. Strong companies should have ROE that is increasing because its net profit margin and/or asset turnover is increasing. On the other hand, a company may not be as strong as investors would otherwise think if ROE is increasing from the use of leverage or debt.

So let's take a closer look at the drivers behind UTX's returns.

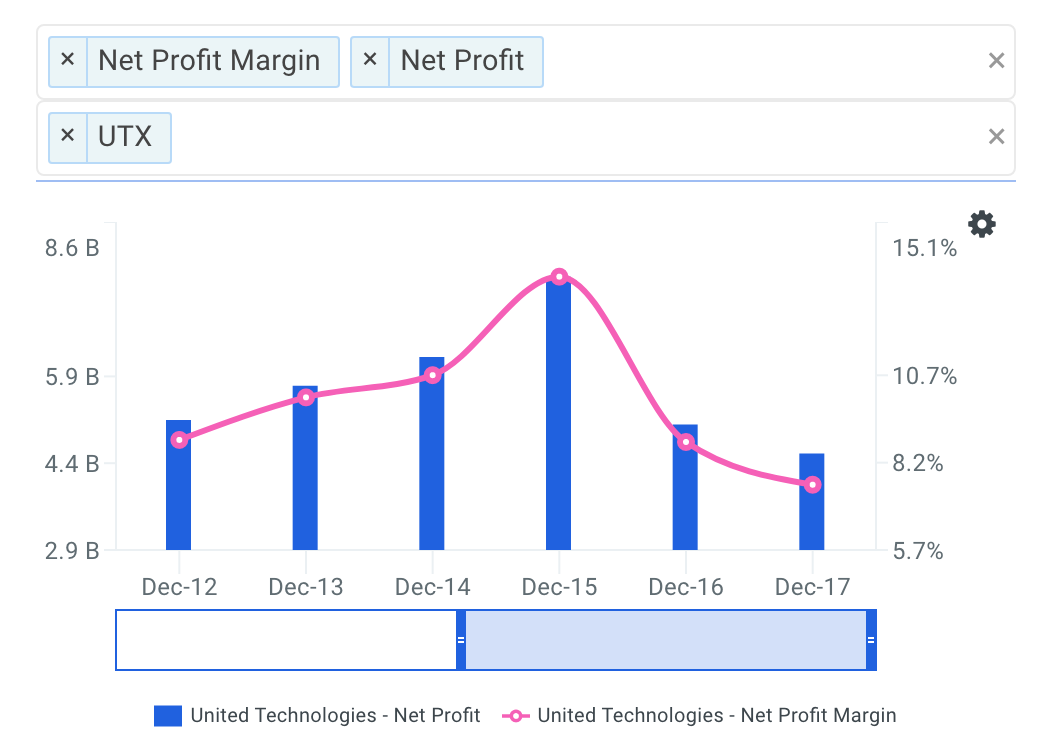

Net Profit Margin

Unfortunately for shareholders, UTX's net profit margin has decreased each year since 2015. Margins decreased from 13.6% to 8.8% in fiscal year 2016, decreased to 7.6% in 2017.

source: data explorer - net profit margin

As a result, the company's worsening margins help explain, at least in part, why ROE continues to decline. However, let's also take a look at UTX's efficiency.

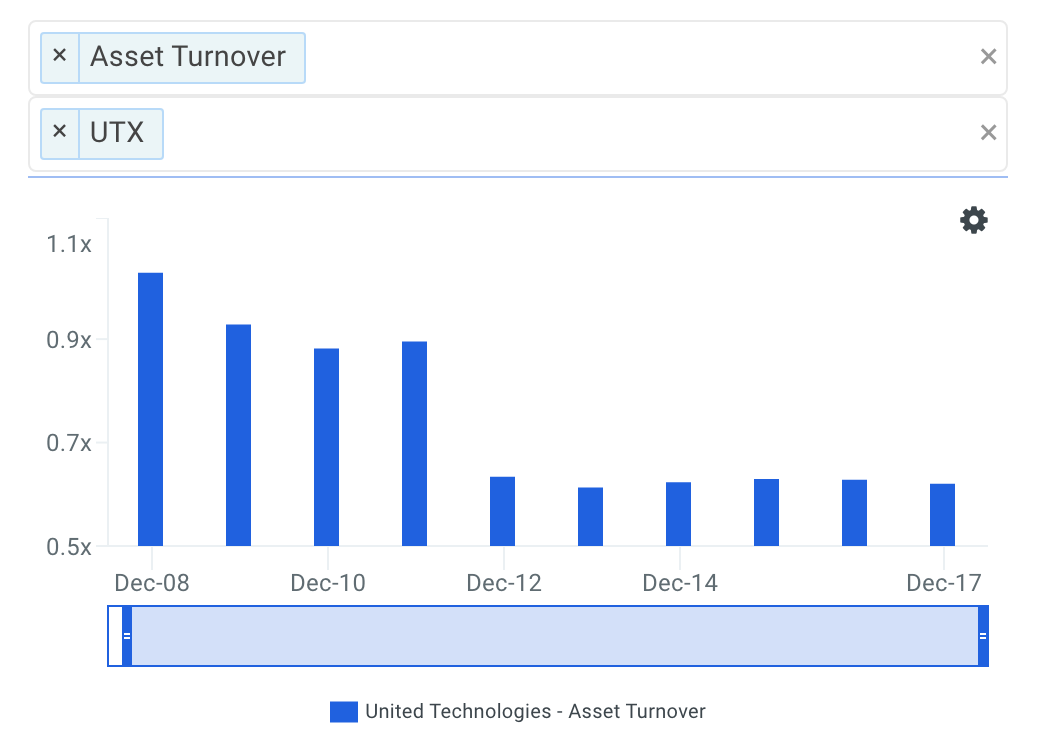

Asset Turnover

It appears that asset turnover of UTX has generally been declining over the last few years. Turnover increased from 0.63x to 0.65x in fiscal year 2016, decreased to 0.64x in 2017 and the LTM period is also its latest fiscal year.

source: data explorer - asset turnover

Therefore, the company's decreasing asset turnover ratio helps explain, at least partially, why ROE is also decreasing.

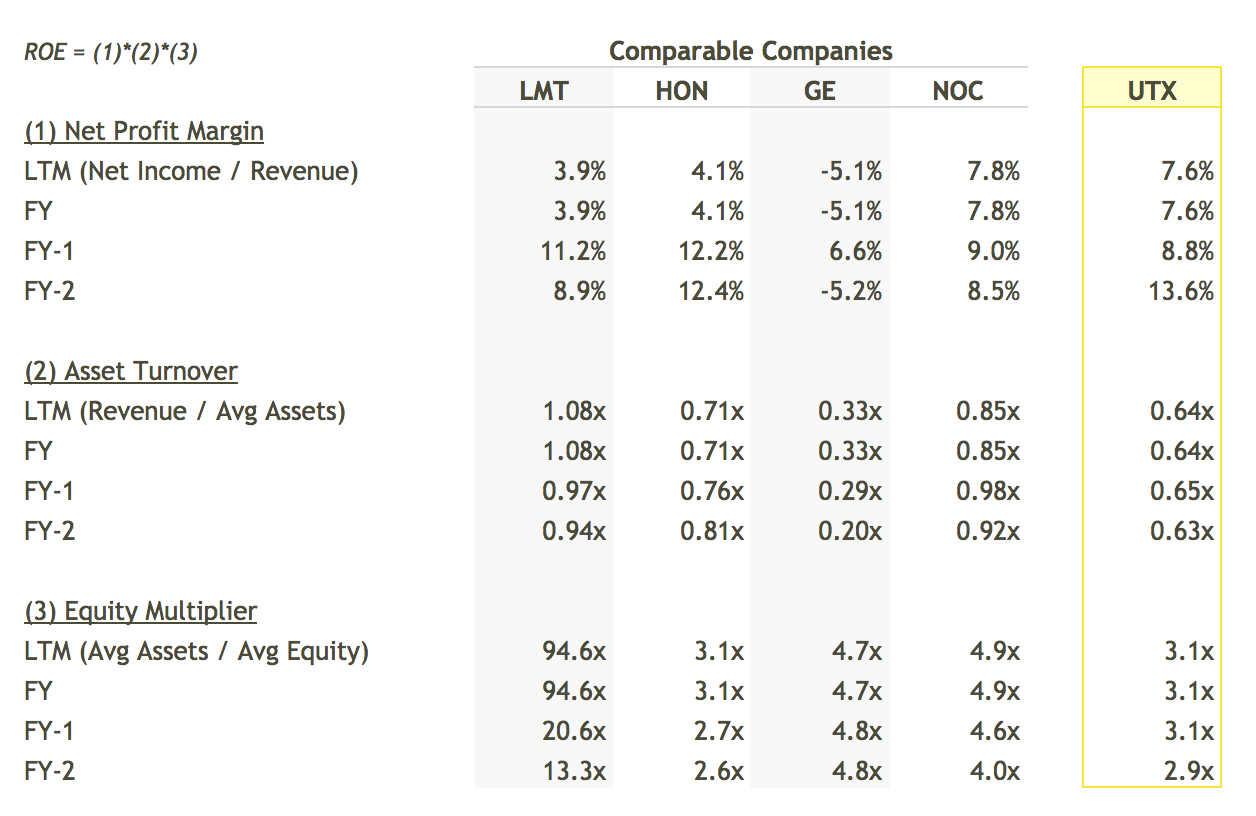

Finally, the DuPont constituents that make up UTX's ROE are shown in the table below. Note that the table also compares UTX to a peer group that includes Lockheed Martin Corporation (NYSE: LMT), Honeywell International Inc. (NYSE: HON), General Electric Company (NYSE: GE) and Northrop Grumman Corporation (NYSE: NOC).

source: finbox.io's DuPont model

In conclusion, the DuPont analysis has helped us better understand that UTX's continuous fall in return on equity is the result of a steadily deteriorating net profit margin, a declining asset turnover ratio and increasing leverage. Therefore when looking at the core operations of the business, UTX shareholders have reason to be concerned due to the company's deteriorating profitability along with a general decline in operational efficiency.

The DuPont approach is a helpful tool when analyzing how well management is utilizing shareholder capital. However, it doesn't necessarily tell the whole story. If you have not done so already, I highly recommend that you complete your research on UTX by taking a look at the following:

Forecast Metrics: what is UTX's projected earnings growth? Is the company expected to grow faster or slower relative to its peers? Analyze the company's projected earnings growth here.

Efficiency Metrics: how much free cash flow does UTX generate as a percentage of total sales? Has it been increasing or decreasing over time? Review the firm's free cash flow margin here.

Risk Metrics: how is UTX's financial health? Find out by viewing our financial leverage data metric which plots the dollars in total assets for each dollar of common equity over time.

Author: Andy Pai

Expertise: financial modeling, mergers & acquisitions

Andy is also a founder at finbox.io, where he's focused on building tools that make it faster and easier for investors to do investment research. Andy's background is in investment banking where he led the analysis on over 50 board advisory engagements involving mergers and acquisitions, fairness opinions and solvency opinions. Some of his board advisory highlights:

- Sears Holdings Corp.'s $620 mm spin-off via rights offering of Sears Outlet, Hometown Stores and Sears Hardware Stores.

- Cerberus Capital Management's $3.3 bn acquisition of SUPERVALU Inc.'s New Albertsons, Inc. assets.

Andy can be reached at [email protected].

As of this writing, I did not hold a position in any of the aforementioned securities and this is not a buy or sell recommendation on any security mentioned.